For beginners in the financial market, trading vs investing can be a tough comparison. Beginners often misinterpret these two words as the same. However, both the terms hold different and discrete meanings than the other. trading vs investing is a standard comparison not completely understood by the financial workers. These terms individually can be explained and described.

To understand trading vs investing dynamic, firstly, it is essential to understand these two terms individually. Although both the procedures of day trading and investing are done to obtain high-profit margins, understanding day investing vs trading strategies can help you to make accurate decisions.

Trading vs Investing: Introduction

Investing

The main motive of an investor while investing their time and money is to get a return over time. Investors look for different opportunities that can add on to their money with passing time. Investing is a long-term procedure of securing an amount in the present with the hope of getting a higher amount in the future. These investing procedures apply to a large variety of services and materials.

However, investing in stocks is the most popular and safe way to build money with time. Investors look for different opportunities for investments that will give them a higher probability of a wealthy return. Other popular tools for investing include stock marketing, mutual funds, investing in bonds, buying and keeping stocks, etc. These tools can help the investors to gain a high percentage of add-on money on the current capital. Investments are made on a long-term basis, and thus an investor considers a lot of criteria while investing.

Trading

Trading is a much faster and less time-consuming procedure of gin and management. Trading is a term used to describe selling and buying certain commodities in a loop to gain profit. These commodities include stocks, products, etc. The whole idea behind trading is the same as investing, to generate and earn profit. However, the investors looking for a simpler and quicker way to gain Profit trading wins the battle of trading vs investing.

The officials investing money in trading stocks can earn up to 15% of the initial value in a year. It is a faster and high pace procedure to earn and run your financial activities. The difference between the selling procedure of certain stocks and buying Price is the actual profit for the trader. The trader needs to understand the trend and trade smartly. When the prices of certain stocks are lower than expected, the margins can grow thicker with time. The trader must buy at the lowest price and sell at the Hobbes.

Trading Vs Investing: Additional Differences

Now, after making the two terms crystal clear in your mind, you need to know how these terms differ from each other. There are many significant differences between trading and investing. These changes can highly affect the decision of the trader or investors. To establish a better understanding, there are various aspects in which the battle of trading vs investing stocks can be summarised. The Characteristics of this battle are listed below:

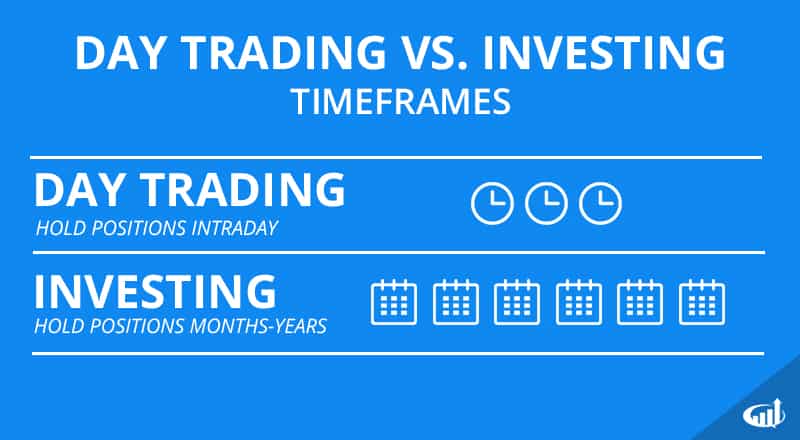

Time

While studying day trading vs investing, the time taken by both procedures plays the most crucial role. The period here indicates the time each process takes to yield noticeable profits to the investors or traders. This time includes the buying, selling, time taken for growth in rates.

Investing is a long-term project. The primary principle of the investing procedure is to hold a certain amount of stocks. This holding of stocks can be done for weeks, months, years, or even decades. However, the investors must understand that investing is a long game. It can take a while for the stocks to give out a good return on the invested amount. Any hurry can result in catastrophic losses during investing. Therefore, while investing, it is essential to select the stocks which provide high-profit returns over time and have a linear growth graph.

On the other hand, trading is a short and quick procedure. Traders can sell, buy and hold the stocks within one day or sometimes within a few hours. The main objective of the traders is to hold the stocks until the price hikes suddenly. This price hike can be noticed within a day, week, or hours. For all the investors looking for an opportunity to gain sudden and high profits, trading is Preferable. However, the trader must be active all the time, as the market can go up or down any minute in a day.

Growth on the Invested Amount

Growth trends are sudden in trading. The traders can understand the market and sell the stocks accordingly. If the market provides satisfactory returns on the stocks traders are holding, they will sell it. Therefore, there is no certainty in the amount of occurrence of growth in your invested amount. Traders have the stocks and wait for the right time to sell them. The traders can earn high profits if the market offers it. The actual capital saved for the traders is dependent on the market trends.

Whereas investing has different concepts of capital growth. The capital growth in investing is stagnant and constant unless stated. While investing, investors can easily keep the crucial stocks and sell them after the desired time. Up till then, they will receive a constant profit out of these stocks. All the investors need to do is to add on the capital interest and manage the dividend. Investors can earn easily out of stocks.

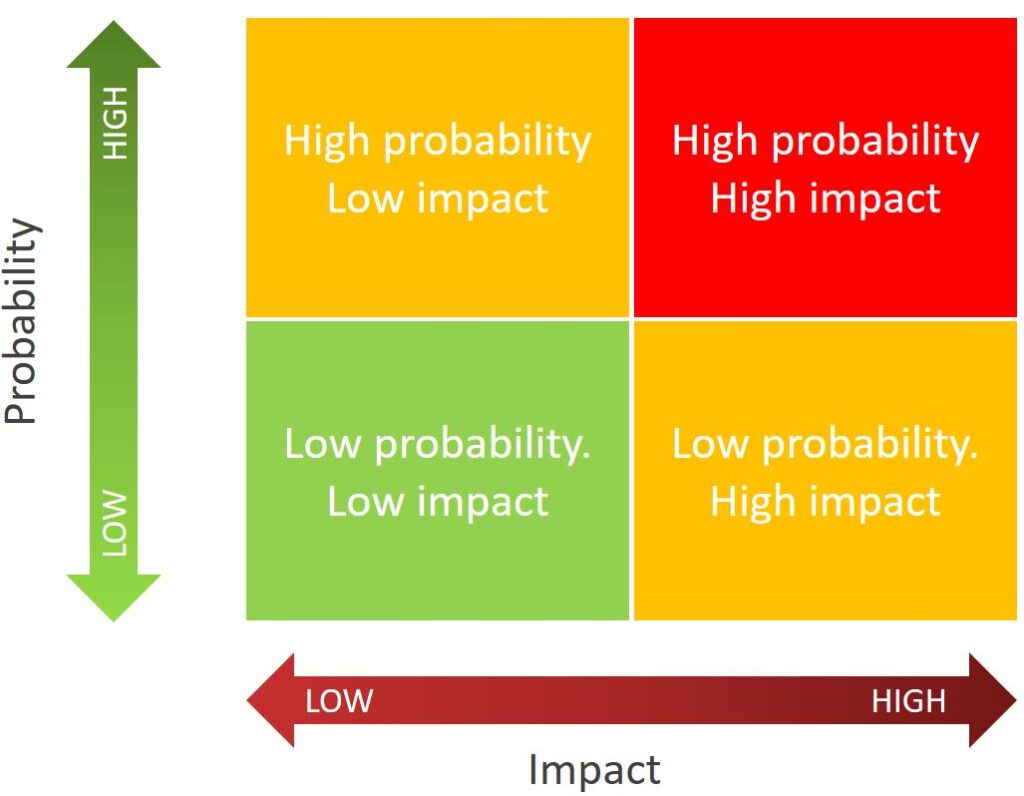

Probability and Risk

The risk of failure is one of the most important criteria to consider while trading vs investing comparison. Both the procedures have different approaches to the concept of risk and probability of loss. Trading involves higher risk on your capital and a varying probability of failure and profit. Trading can provide you with high-profit returns or can become a loss statement. It depends on the trader and the market. Trading accounts for high risks associated with a higher profit scale. For the investors with extra money on hand to put at risk, trading is appropriate and the correct approach.

However, investing is different. The risk factor associated with investing is low. But, the risk of investing in the wrong stocks still hangs on the investor’s head. However, the probability of loss is minimum in investing. The investors can take the invested amount out of the stocks whenever they wish. A few chances of failure of a stock company can be a reason for the loss in investing, but that is rare. Therefore, if you have a limited amount on your hand and wish to grow it over time, investing can be a better and more secure option for you.

Art and Skill

Investing vs. trading can be settled on one more important criterion about the skills you need. Trading is a procedure that requires skills. The trader must have appropriate skills to manage the stocks daily. The market can turn the tables suddenly. It is the responsibility of the trader to manage the stocks accordingly and minimize the loss. The trader must use his/her skills to guess and buy the stocks with a higher probability of a hike in Price. These skills can be excelled with time, yet, initially, also, the traders must have these skills. The skills of the trader determine the final amount he will receive.

The scenario in investing is different. Investing can be categorized as a procedure that requires art. The art of investors to manage the compound interest and dividend determines higher profit margins. Investing is usually a winning game; however, it may take a lot of time for the investors to understand better this art of investing.

Concerned People

Investing and trading are different fields of capital investment and financial accounting. Therefore, the people performing these two techniques are different from each other. Traders are the officials responsible for the regular buying and selling of stocks. The primary goal of which is to reduce the loss and maximize the profit in less time. Day trading v/s investing requires different times from the concerned officials. Trading can be done by people available all day for the working hours of the market. As the task of a trader includes analyzing the market at every instant.

Although investing is a lengthy procedure, the investors might not invest much time into it. Investors need to study capital formation after including interests and deducting dividends. Investors must perform constantly and efficiently over a long time to gain trust in the market. On the other hand, the traders can include short-term trades in their portfolios and make a good impression.

Winding Up

To settle this confusion of trading vs investing, the up-listed factors can make a huge difference. If you’re confused about which field to select for investing money and time, you need to analyze your current situation. This selection is entirely based on your choice of working path and the result you wish out of your investments. Both the fields are well versed and appropriate in their manner. Thus, the selection criteria on which selection will be made depends on the investors. We hope that this trading vs investing comparison helped you to choose.

To know more about Best Trading Strategies read this article.

Frequently Asked Questions (FAQs)

- What should we choose: Trading or Investing?

To be honest, there is a risk in both trading and investing. But, trading may include higher risk factors. Also, you can have higher returns with trading. You first have to learn how to invest because it is not that easy, and you need time to understand it properly. To know more, check out the whole comparison of trading vs investing.

- Is day trading worth it?

When it comes to day trading, you got to earn intraday. You are not going to hold your stocks even for a day. It is somewhat risky, but if you play it right, you can get a reasonable price.

- Can invest in stocks make you rich?

If you invest in the stock market, you can surely make decent money only if you follow the right strategies for the same. If you purchase stock for a day or two, you can earn money with the correct strategy.

- What is the best strategy to become rich?

You may have to follow some rules to become rich. They are:

- Controlling your expenses

- Choose what you need to do

- Make long term goals

- Clear your debts

- invest