What is Max Pain Options :- Overview, How It Works, Calculation.

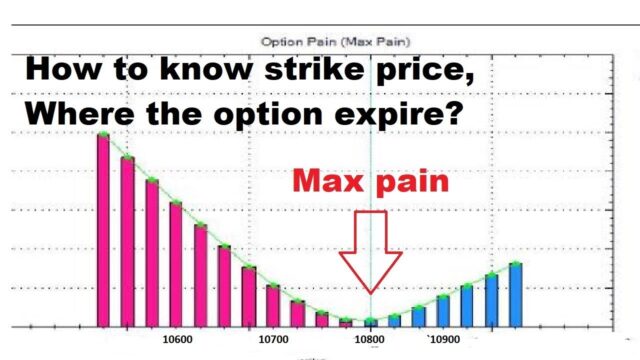

Max pain generally occurs near the expiry when the stock price locks in on an option price that would cause the maximum loss to the option traders. During the last days of the month, the max pain theory states that the underlying stocks mostly come near the strike price to bring maximum losses to the option traders.

What is Max Pain?

Max pain is generally referred to as a controversial theory known as maximum pain theory. It defines that the traders and investors will suffer the maximum loss if they hold the contract until the expiry. The occurrence of this theory is based on two different assumptions, which are:

- The first thing that is considered while calculating this theory is the legit buying and selling of the options contract, which the traders do for hedging. And in the last days, the strike price moves towards the index price that will cause maximum loss to the traders.

- The second assumption is wholly based on how large institutions manipulate the index price to generate profits. These institution option sellers hedge large amounts of their portfolios to easily alter the index prices, resulting in no issues settling the contracts on their side and hedging the payout to the buyers.

The index price is manipulated by both sides to settle the stock price towards the more profitable side. The maximum purchasing power will devise the movement of the stock price.

You should also know about autotrading, Learn here.

According to stats, almost 10% of the stocks are generally exercised, and 30% expire worthless, while the trading percentage of the stocks is around 60%. Max Pain theory happens when market producers arrive at a net positive place of call and put choice at a strike cost where choice holders remain to lose the most cash. On the other hand, choice dealers might procure the most after selling a more significant number of choices than purchasing and making them terminate uselessly.

As discussed above, the max pain theory is somewhat controversial and the manipulation of the stock. The critics that define the max pain theory are divided into two different scenarios: the max pain of the stock price occurs by chance or because of market manipulation. Several other questions arise once the market settles down about the oversight of markets.

The Securities and Exchange Commission (SEC) oversight is credited to administrative conduct. Such conduct is impacted by the size of monetary advantages from the plans, also the undercover idea of the impact. Market members offer pay-offs to controllers as cash or future work possibilities.

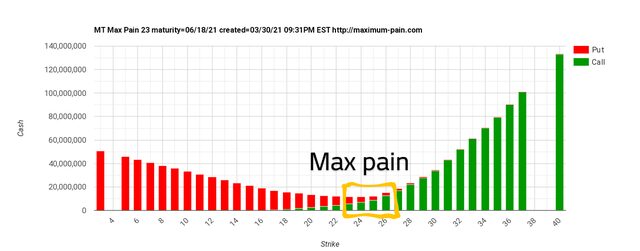

How To Calculate Max Pain?

The process to calculate the Max Pain is quite complex, and it takes enough time to add on all the outstanding put and call value of each stock in the money stock price. We have listed below the steps to calculate the Max Pain:

- Determine the difference between the stock price and strike price.

- Now calculate the product of the results and the Open interest at the strike price.

- At the strike price, sums up the dollar value of the call and put orders.

- Follow these steps for all the strike prices.

- The highest calculated value for the strike price is the max pain price.

The process of using the max pain as a trading tool can be complex, and the price calculated using the max pain may fluctuate hourly or daily. Hence, it is necessary to find out the difference between the max pain price and the stock price near the expiry date.

Want to learn about stop on quote here! It will helps in your trade to minimize your losses.

The reasoning behind such a thought is that there could be a propensity at the stock cost to sway around the maximum aggravation; however, the impacts might be negligible until the lapse draws near.

Let’s Discuss Max Pain Theory With an Example

Accept that Company XYZ Limited needs to exchange its investment opportunities when stock choices are exchanging at a strike cost of $51. In such a case, there is a substantial open interest on the investment opportunities at strike choices somewhere in the range of $54 and $55. At last, the maximum agony cost will settle at both of the two charges since they will deliver the most significant upsides of the organization’s investment opportunities to terminate uselessly.

Learn the best investment rule the rule of 70 here.

In a second guide to delineate the idea, consider Company X with a few agreements exchanged on its stock, with the more significant part at a strike cost of $50. Assume that during the termination time, the organization’s stocks were exchanging at $50. It implies that any strike cost of $50 would be in the in-the-cash and, consequently, lapse useless.

Here are the best candlestick pattern which you should have to know about, read here.

The thought is that any given security’s maximum cost at a termination date can be anticipated with sensible precision to decide when to sell choices for benefit. This idea works best under typical exchanging conditions.

Frequently Asked Questions

- What Is Max Pain theory in general?

Ans: The Maximum Pain theory expresses that an option’s cost will float towards a maximum aggravation cost, sometimes equivalent to the strike cost for a chance, making the most extreme number of choices terminate uselessly.

2. How accurate is Max Pain Theory?

Ans: The thought behind Max Pain theory is the way that Option sellers will generally control the expiry cost of stock, file, or item, so they benefit the most out of their positions. Even though there is no actual confirmation of how they control the costs, this theory is broadly acknowledged.

3. What is Max Pain in Sensible?

Ans: Max Pain theory says a stock has a high shot at lapsing where the choice dealers will have the minor misfortune and purchasers have the most significant trouble.