What is Subordination Clause and How it works?

What is a Subordination Clause?

A Subordination clause is used in the agreement to define the priority of the clauses mentioned. In an agreement, a Subordinate clause states that the current claim will have more priority than any other claim in any other agreement that will be made in the future. This method is used to set the priority of the claims when you have multiple agreements. Below, we will discuss in detail this clause and its applications.

What is rate of change Formula and how to apply, Read the full Guide.

Subordinate Clause – How Does it Work?

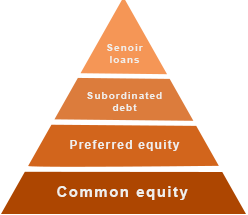

A subordination clause essentially prioritizes the present claim in the agreement over any subsequent agreements. Loan contracts and bond issue deals are the most usual places to see these terms. When a house is foreclosed and sold for cash, the primary contract loan expert gets first dibs on the deal. Any money left over is used to pay down a future mortgage, for example. If a firm publishes bonds in the market with a subordination clause, for example, it assures that if new bonds are issued in the future, the original bondholders will be paid before the company pays any subsequent debt.

Monetary Condition Index, Read the full Guide here.

The lower a petitioner’s home loan level, the less chance it has of recovering its credit balance. A bank may request a subordination condition to modify the demand for credit in the event of default, without which advances take precedence. This provides additional security for the original bondholders, as a subordination provision raises the chances of them receiving their investment back.

Subordination provisions are most typically found in refinancing agreements for mortgages. Consider the case of a homeowner who has two mortgages: one primary and one secondary. When a homeowner refinances his principal mortgage, the first mortgage is effectively canceled and a new one is issued. When this happens, the second mortgage rises to principal status, and the new mortgage becomes subordinate to it.

What is max pain options and how it can help you in your trading and investing, Read Here.

Because of the shift in priority, most first lenders need the second lender to furnish and sign a subordination agreement, committing to stay in its previous secondary position. This technique is usually part of a refinance’s normal procedure. However, if the borrower’s financial status has deteriorated or the property’s value has decreased sufficiently, the second mortgage creditor may seek repayment. In most cases, this is a typical refinancing procedure. However, if the borrower’s financial position has improved or the property’s value has dropped sufficiently, the second mortgage creditor may refuse to implement the subordination clause.

A subordination clause permits the principal mortgages on the same property to have a greater claim if the secondary lien holder supplies one. If repayment becomes difficult, such as in the event of bankruptcy, the subordinate loans will lag behind the principal mortgage and may not be paid at all.

Conclusions

That is all you need to learn about the Subordination Clause. In Case, you have any queries or issues then feel free to reach us in the comments.