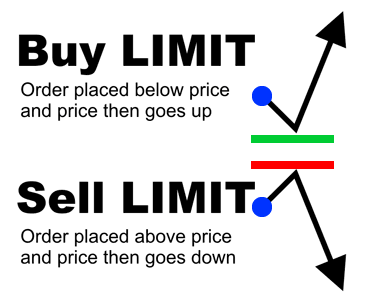

A limit order is the most used one by professionals from various types and kinds of orders. A limit order is a kind of Order that allows you to buy and sell the stocks at a limiting price. This price is set by the trader beforehand. Your broker can sell the stocks and entities at a price more than the amount you quoted earlier. In the case of buying the stocks, the chosen stocks will only be purchased if the price is either equal to or less than the quoted price by the trader while putting out a limit order.

Limit order provides full access and ability to the trader and investor to decide a price. The traders can study the market and fix a price they find the most reasonable. They can also limit the value at which they will buy particular stocks. This helps them to reduce the stress of constant market revaluation. Once the market price reaches their range, they get notified by their broker. This improves their profit margins and earning capability out of the same stocks.

Let’s Know in Detail About Limit Order

Limit order gives security and surety to the investors. It secures the investors regarding the least amount they will get for selling certain stocks. Also, they are secure of the Maximum amount they will have to pay to buy stocks of their choice. However, the investors are not confident about one thing, which is the filling of stocks. It is not essential or sure that the price given by the trader is met with the market price. In this case, the trader will have to wait until the market bends its way. This may take a long time in some cases.

Until the price situation favours the trader from both the selling and buying point of view, the stocks chart remains unfilled. The investors need to understand that they don’t need to get a whole-house rapidly after putting out a limit order. The rates in the market can take a considerable amount of time to match the quoted prices. If the investors are looking to fill the stocks chart faster, they need to limit the stocks with specific price changes.

This can increase their probability of getting the quoted price sooner. But initially, the sudden changes in rates can not be expected as soon as the limit order is released. Also, suppose the market changes too rapidly. In that case, investors miss the opportunity to fairly trade their stocks at a better price due to the availability of limit price on the stocks. The stocks will be sold only above the bar of the order price. However, there are chances where the prices may hike below the bar, and investors fail to sell the stocks at a further reasonable rate.

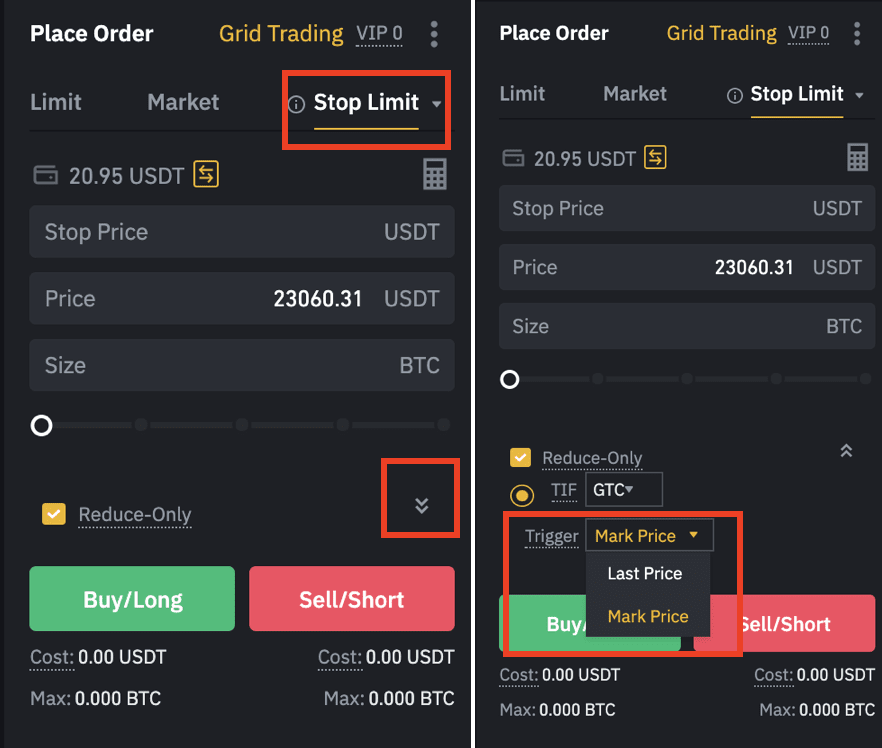

The best way to prevent this kind of losses, you can always use stop orders in combination with the limit orders. You can put a stop-limit order on your trading, which will allow and prevent you from the losses related to limit orders.

Application of limit order

The limit order is a technique of putting a pre-decided price, selling and buying certain entities and stocks. This gives the executive powers to the trader. If the trader is not willing to risk the stocks trading in a rapidly changing market, they can use a more secure method of limit orders. The investors not looking for filling stocks instantly can make use of limit order and collect its benefits.

The primary application of limit order is when you are not watching the market regularly. The investors can decide on a fixed price at which they want to sell or buy a particular stock type without constantly tracking the market. They can follow the main events from the history of the stocks to decide the maximum potential they hold. The price, thus, can be determined by considering the history and possibility of the stocks. This allows the investors to sit back and relax. Once the market price matches the price quoted by the trader, it can be bought or sold.

Another application of this order is in a highly unstable and volatile market. If the investors are not willing to take a chance regarding constantly changing prices of the stocks by putting a market order, they can use this order to decide the minimum cost of the stocks.

Other than this, it keeps you in charge of the significant decisions regarding selling and buying your stocks at your own price.

Difference Between a Limit Order and Market Order

A market order is precisely the opposite of the limit order for trading. A market order allows you to sell or buy the stocks at the earliest possible instant. The trading can be done on the current market price of the stocks. The most beneficial or the price comfortable with the trader can not be fixed.

Only the price available on the market is considered. On the other hand, it allows you to put a minimum or Maximum price for selling or buying the stocks, respectively. The market order is a quickly moving approach. However, the limit order process takes time. If an investor wishes to earn profits from the stocks instantly, they can put a market order. And if the investors need maximum profit margin and have no bars of time on trading, they can choose this path for selling and buying stocks.

Conclusion

A limit order is a secure way to pre-define the rates you want to sell or buy certain stocks according to their performance. Although the limit order is fast, there are chances of facing a loss situation if the stocks are appropriately filled. The filling criteria are not satisfied by the limit order design. However, if you want to earn maximum profits by selling your stocks at the right price and save margins by buying stocks at the lowest possible rates, you can use it for trading. We hope this guide has helped you.

Also Read: The difference between Trading vs investing.

Top 10 factors to check before buying a stock.

Frequently Asked Questions

-

How does Limit order work?

A limit order is where you sell or buy the stock at a particular price or better than that. You can buy a stock when it is less than the specified price, and you can sell when the stock price is more than the limited price.

-

Which one should I use: Limit Order or Stop Order?

When it comes to limit orders, your broker will know when to sell or buy a stock at the limited price. Other than this, you will have to get the order filled even at higher prices than you expected when it comes to stop orders.

-

Why is the Limit order not filled?

If the price of the stock is above the limit price, the order becomes null. This is because the investor wants to invest that particular amount in stock only.

-

How to cancel stock Order?

You can only cancel the limit order or stop order until it is not filled. You can do that anytime. Usually, the limit order is in waiting until it reaches the required amount. So, if you wish to cancel the limit order, you can do it quickly.