For all the traders, one of the most challenging questions is what to look for when buying a stock or what to look for in a company when buying a stock. Traders are required to make an intelligent choice regarding investment in a particular stock or company stock. They have to look for various factors while finding the best yielding and profitable stock to them. To answer this critical question of what to look for when buying stock, you need to analyze your situation concerning the market. Read this complete article to know what to look for when buying a bank stock and more.

Here’s What to Look for When Buying A Stock

There are some essential factors you need to look at while buying a stock carefully. It is preferable to pay attention to these factors to improve profit margin and reduce the chances of loss. Check what you need to look for when buying a stock

Investment Period

While buying a stock, it is essential to decide the amount of time you want to invest your money for. You must monitor the time horizon of the stock and match it with yours. There is a time horizon related to a stock, after which it provides good profit margins to the trader. However, sometimes this time horizon exceeds the period for which the trader wishes to invest money. This leads to a loss in trading. There are three-time horizons for which traders can choose to buy a stock. They are

- Short term stocks

- Midterm stocks

- Long term stocks

All these stocks vary in the investment period. The short term stocks are those stocks investments that are made for less than one year or one year max. At the same time, the mid-term stocks investments can range up to 5 years. These stocks yield good profit after a few years of investment.

Similarly, long-term stocks are those stocks investment where you invest your money and time into a company stocks for an extended period of time and get profit margins out of these. However, what to look for in the company when buying a stock entirely depends on the trader’s choice.

Understand and Follow an Appropriate Investment Strategy

Initially, when buying a stock, you must decide what strategy you wish to pursue trading that particular stock. There are various strategies available for trading different types of stocks. You can also combine two different strategies and follow them as one. For this, you need to understand the investing strategies first. There are three main investing strategies available for traders for trading certain stocks. These are :

- Value investing is simply a technique of investing in stocks that are available at lower prices compared to the others in the same genre. It also regulates the trader in selling these stocks at a relatively high price, making the profit margins broader.

- Growth investing: growth investing is one of the most traditional strategies to invest in stocks. It is a strategy that allows you to invest in growth stocks. By growing stocks here, we mean the stocks that show a high growth rate in profit, sales, and other categories. While using the growth investing strategy, you need to check if the stocks have a linear growth rate in the profit aspect. It might give you a parameter on what to look at in the graphs when buying a stock.

- Income investing: as the name suggests, it is the investment to make a certain amount of income for a desired group. These stocks must be potential and high paying. This margin is, however, considered as an income or can be used for further investments. Any income coming from stocks managed under income investing is considered passive income. This passive income can be divided or kept safe according to the trader’s team situation.

The traders must combine or use any of the listed strategies to reduce the risk of loss. These strategies also provide a solution to guessing problems and inaccuracy in stock trading.

Expand your Horizons

For all the traders establishing their name in the market, it is important to expand their horizons and choices of stocks. For all the investors and traders, choosing different genres of stocks is proven to be profitable and advantageous. It also helps to create a stronger and more diverse portfolio for the traders.

You can include stocks of various industries and markets to your list. This will help in making your portfolio impressive and diversified. However, extra profit is an added advantage. You can buy and sell in different domains and regions. This will also help you to obtain data about growing stocks in different regions.

Compare Prices Carefully

Traders often forget to compare the prices of different trading stocks and different sellers. This results in reduced profit margins. To make sure that your profit margins are exceeded and maximized, you need to compare the sharing prices of different stocks available in the market. You must observe carefully that the price at which the stocks are being sold is higher or lower than the actual expected price of stocks. Once it goes down the graph, you can buy it and sell it once the bars are high or favorable. You must keep a close check on various ratios showing the valuation of stocks. These ratios include:

- P/E or price to earnings ratio

- P/S or price to sales ratio of the company

- P/B or price to book value ratio

These ratios can determine if the stocks are available at their best prices, or you can buy them at lower prices. Accordingly, traders can invest their time and money into a particular stock.

Understand Company’s Books

For the investors and traders to make a correct and accurate choice, it is important for them to understand the company’s books. Books majorly include their balance sheet. Having a look at the company’s balance sheet can give the investor a clear picture of the financial situation of the company.

The balance sheet can inform the investors about all the assets, loans, expenses, and debt of the company. Also, traders can have a detailed analysis of the stakeholders and shareholders of the company. This helps the trader to make an accurate decision regarding investments. So, keep the balance sheet on the top of the list of what to look for when buying company stocks.

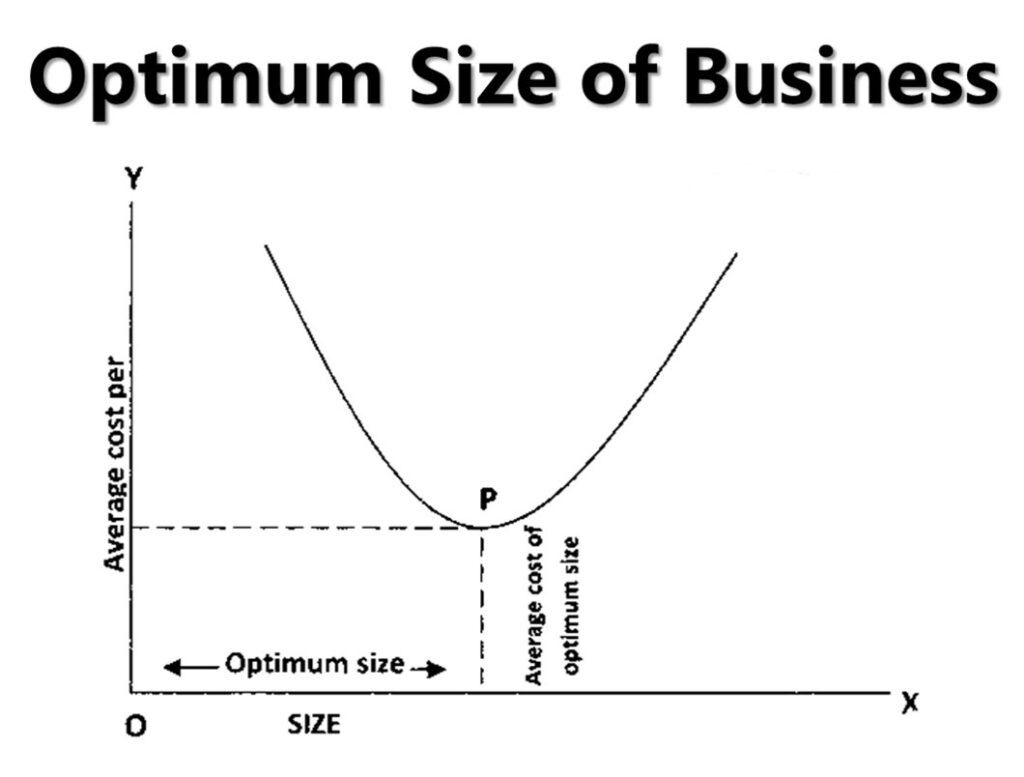

Size and Scale of the Company

The next thing on the list of what to look for in company when buying stock is the size of the company. A company’s size and reputation matter a lot while investing your time and money. The traders must examine and consider the size of the company before investing.

You can easily observe the company’s size by measuring its market capitalization or market value in international space. It can highly affect your profit margins. As the risk of loss decreases with the increasing size of the company, the traders must pay huge attention to this factor. The standard categories of stocks companies are widely divided into three. These categories are:

- Penny stocks or small caps (having market value less than $2 billion)

- Mid-caps (having a market value of more than 2 billion dollars yet less than 10 billion dollars)

- Large caps( having market value above than 10 billion dollars)

The traders can invest in an appropriate company of the desired size. This will help them to analyze the growth and expected finances accordingly.

Volatility

Volatility is a simple parameter to describe the change in rates of a stock and the pace at which it changes. Volatility is referred to the pace of stock to raise its value or reduce in the market. It shows how quickly the profit margin can change regarding a stock.

To observe the performance of a particular stock, you can check its volatility. If the volatility of the stocks is high, it means you can make more money in less time. However, if the volatility is low, the stock changes its value slowly with time. Therefore if you’re looking for a long-term investment option, you must look for stocks with low volatility. But if you wish to do day trading with the invested stocks, it is advised to buy stocks with high volatility.

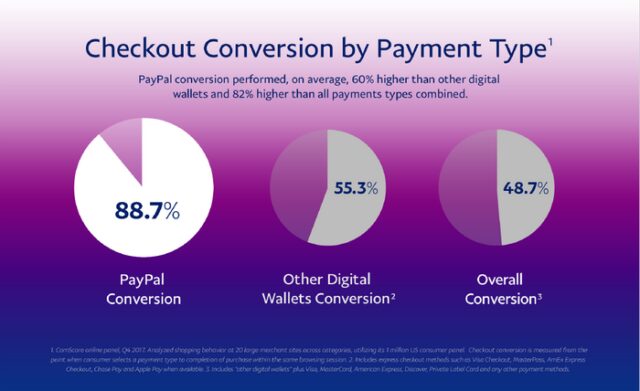

Payment Systems for Investors

After investing, it is equally important to gain profit in a hassle-free method. Before investing in stocks, you must check the dividend system the company follows to pay back the investors. The dividend is a system to pay a fixed percentage of profit to the initial investors. This helps the investors as well as the company to manage their expenses accordingly. It also reduces the chances of cheating and improves business relations.

Also, the investors must check dividend history along with the current working system. It tells a lot about previous experiences and working of the investors in a certain company. While purchasing stocks of a company, investors must be sure of getting a fair share of profit. Few factors which you must make sure of while glancing at the Dividend history of the stocks of the chosen company are:

- Financial security of the company- while looking into the books and observing the dividend history, you must check if the company is financially strong. If the company has a clear dividend history, it means it is secure, and the chance of loss is minimum. However, it is safe to check the books thoroughly and then make a decision.

- Regular payments on dividend account

Initially, the companies may give a huge dividend to the investors just to tempt them into investing money, which can be a reason for the lack of extra cash with the company. This is not in favor of the investors as, with time, the dividend decreases. Therefore it is safer to invest in a company that offers regular and legitimate dividends, which leaves them with some extra expenses.

Make Sure the Dividend is Growing

The next thing that you need to look for when buying a stock is the dividend. As investors, it is important to have an income with a positive linear graph. However, if the company’s history shows a stable and same amount of dividend, this can turn the investors against them. Look for a company with increasing and growing dividends that will ensure their growth as well.

Look at the Books to Check Revenue Generation and Earnings

Investors must check if the company they are interested in is growing or not when buying a stock. As the ultimate goal of the investor is to gain profit out of all the investments in stocks. To make sure that you’re buying stocks of a correct and rapidly growing company, investors need to check their revenue generation and also the earnings they make.

These factors can well explain if the company is growing, failing, or how it will perform in the future. This can majorly affect your decision to invest in stocks of a certain company. Although revenue and earnings are both accounting terms, people often get confused in understanding the actual meaning of these terms.

Revenue and earnings, in simple words, can be described as:

- Revenue: Revenue is the total amount a company gathers after selling a product or service to the customers. The revenue is an actual amount that the company gets from the customer in exchange for a product or service. Revenue remains untouched by other expenses. It only indicates the amount customers pay to the company.

- Earning: Earnings are somewhat different from revenue. Earning is the amount of money that the company saves after removing other expenses. It can also be called the profit a company makes on a certain product or service. Expenses such as making, marketing, transportation, etc., are subtracted from revenue to get actual earnings. Earnings are the actual amount the company gets in hand after removing all the associated expenses.

The company with high revenue may not have high earnings due to high charges associated with the product and services. Therefore, it is advised to look at both factors before investing in stocks of a company.

Determine the Kind of Stocks Offered by the Company

So, when buying a stock, you need to check the type of stock that the company is offering. Majorly, there are two kinds of stocks offered by various companies. The stocks can either be preferred stocks or common stocks. Investors can select any kind of stocks they like as per their choice and investment requirements when buying a stock. To make an accurate choice, it is important to understand both terms clearly. Preferred stocks and common stocks can be defined as:

- Common stocks: common stocks are the kinds of stocks vastly bought by most investors. Common stocks are available in high amounts by the company. It is announced by the company prior about the dividend and other stockholders ensuring high-profit margins for the stockholders. These stocks are majorly bought as compared to other stocks of different companies.

- Preferred stocks: preferred stocks are those stocks that are preferred by investors for high investments.

Conclusion

So, this was what to look for when buying a stock. These are some major factors that you need to consider to choose the right stock for investment. Hopefully, this helps you.

Hope this article helps you to make money from stock market and give you the best trading strategies for beginners.