The definition of financial freedom is different for different people. Some people may believe that financial freedom is all about getting what they want without caring much about the money that they have to spend. For others, financial freedom may mean being free from all kinds of debts. For some, financial freedom is all about being rich. To a certain extent, these answers may be correct but are not entirely accurate. If you want to know what financial freedom is and how to achieve financial freedom, this guide is for you. Read till the end to learn more.

Financial Freedom

As we have mentioned, the meaning of financial freedom is different for different people. For us, financial freedom is all about controlling all your expenses. It simply means that you have enough money to live your life the way you want. Also, you will not have to worry about paying bills, clearing off debts and more. It is not essential that if you want financial freedom, you will have to become rich. If you have enough to live freely, you are financially independent. To help you know how to achieve financial freedom, we have listed nine steps in this post. As soon as you fulfil one step, you will be one step closer to financial freedom.

Stages of Financial Freedom

Before we explain to you how to achieve financial freedom, here are the eight stages of financial freedom.

- No Paycheck to PaycheckLiving: it simply means that you do not have any tight financial conditions. You have enough fund with your for emergencies.

- Have Money Even If You Quit Your Job: though you can not always survive if you quit your job, if you do, you have enough money to stay for some time.

- Stable and Happy: You are earning enough to do all the things you like and save money.

- Time Freedom: You are doing what you like, and you will not be broke even if you fail.

- Basic Retirement: You have enough funds to take early retirement by reducing your lifestyle

- Retire Well: Enough income or passive income to live life as you want even after retirement

- Dream Retirement: Enjoying your life more than ever after retirement

- Spend More Save Less: you already have enough money that you can not even spend.

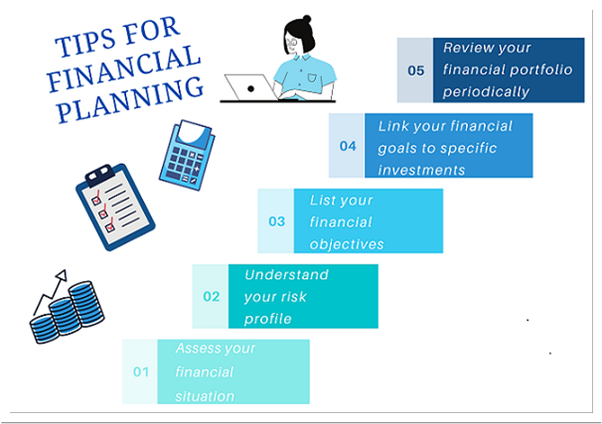

How to Achieve Financial Freedom: 9 Important Steps

Analyze Where You Currently Are

The first step in how to achieve financial freedom is to analyze your current situation. Analyze where your financials currently are and how educated as well as physically fit you are. Other than this, you need to check the remaining pay bills, debts, monthly expenses, savings, and your income.

You must know everything about your financials so that you can decide what you need to do next. When you know all this and have a clear idea of the same, it is only reliable to switch to the next step.

Note Down Your Goals

Now that you know everything about your current financial conditions, you need to note why you need all the money. You may need money for different reasons like paying off your education loan, your wedding, buying a home, or more. Your goals are what you need to do as soon as you have enough money with you.

, you need the money to fulfil the financial needs. But, if you do not know why you need the money, it will be purposeless. So, noting down all your goals can help you achieve financial freedom. Other than this, make sure that you have set SMART goals for yourself. It means they should be specific, measurable, realistic, achievable, and time-bound. So, if you plan to get ten crores by the end of 2030, it is a smart goal that you can achieve if you want.

Look Out Your Spending

If you want to know how to achieve financial freedom in 5 years, ask yourself where you are spending most of your money. To track your expenses, you can either write them down in a notebook or use an excel sheet for it.

When you track your expenses, you become more accountable for your spending. Also, it helps you analyze where you are spending most of your money and where you can cut off unnecessary spending. Other than this, it will stop you from making any impulsive buy. Impulsive buys are sometimes the main reason you are not able to achieve financial freedom.

Keep Some Money for You

We agree to be financially independent; you need to control your expenses. But, we will always advise you to keep some money for yourself. You can keep it aside from your monthly income so that you can use it for emergencies.

Keep these funds aside even before you pay all your pending bills. When you ask financially independent people about joe to achieve financial freedom, they will surely tell you to control your expenses and save money for yourself.

For example, if the amount left with you after paying all the bills is not enough for you, you will be forced to make adjustments in your necessary payments, or you may take up some extra work to get the required money to spend. No matter what, if you keep money aside, it gives you an idea of how financially secure you are for the future.

Fewer Expenses

You have heard many people saying: spend less, save more when asked how to achieve financial freedom. Well, this point is also all about it. If you want to save money, you need to spend less on what you do not need. Impulsive buying is the prominent example of it.

But, you also need to know that when we say spend less, it does not mean that you have to compromise with your lifestyle and requirements. But what do we mean is that you have to stop spending on items that you do not need. Make food at home to control going out or enable auto-bill payments so that you do not forget it and end up paying extra charges on it. Also, if you postpone buying something that you do not need, it will not affect you.

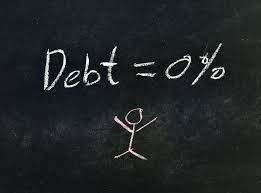

Clearing Your Debts

One of the most critical points in how to achieve financial freedom process is to clear all your remaining debts. This will help you to achieve financial freedom in different ways. First, when you remove all your debts, the cash flow in your account will increase and secondly, you will be relieved after paying an enormous debt.

When it comes to clearing debts, you can use two different approaches. The first one is to clear all your smaller debts first and then move to the bigger ones. The second method is to remove the most significant debt first and then move to the smaller one.

No matter which method you use, it will undoubtedly help you get the required financial freedom.

Keep Growing Your Career

One of the essential elements of how to achieve financial freedom is that never stop at a single place in your career. Learn new skills, go for the higher-paying job so that you can earn even more money. For example, if your career is growing at an incredible pace, your income will surely increase. If you learn new skills, you are going to get better jobs.

To be financially independent:

- Keep growing your career at a consistent pace.

- As you will earn more, you’ll save more. Never leave it to chance.

- Make efforts to grow your career.

Sometimes all you have to do is have a better income and career, and your finances will improve on their own.

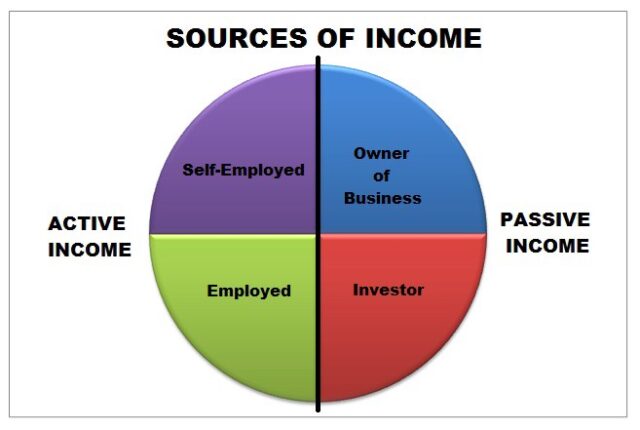

Add Sources of Income

Saving money is not enough every time. You have to make a lot of effort to become financially free. There are chances that the current income may not be sufficient for you so, adding ab extra source of income can help.

To generate additional income, you can use two ways. One is passive, and the other is active. For the active method, you will have to trade the time for the money. Whereas, in passive income, you will have to work once, and the money will keep coming to you.

If you want to choose an active method, you can work as a freelancer in whatever field you are good at. But, passive income may include affiliate marketing, selling content on the internet and more.

Investing

Well, only saving money is not going to help you. If you have cash in your account, you are going to spend it indeed. So, to keep the money, invest it in something you will get good profits from. Make sure to invest your saving as soon as possible. You can make money from stock market.

To Wind Up

These were some of the steps about how to achieve financial freedom. All nine points will help you become financially independent, but you need to have SMART goals. So, if you want to know how to achieve Financial Freedom in 5 years, start following the steps now, and more steps that you will cover, faster you will become independent.