All About Standard Error Formula

What is the Standard Error Formula?

In measurements, the standard Error is a mathematical methodology for computing inconstancy. The standard error (SE), at times known as the standard mistake of the mean (SEM), is a measurement that addresses the standard deviation of an example circulation as a level of the mean worth, though the standard error of the mean (SEM) is a proportion of how much the example mean (normal) of the information is relied upon to vary from the certified populace mean.

Read what is subordination clause and how it works?

The SE technique is utilized to ascertain an example’s proficiency, exactness, and consistency. At the end of the day, it surveys how much a testing appropriation precisely addresses a populace.

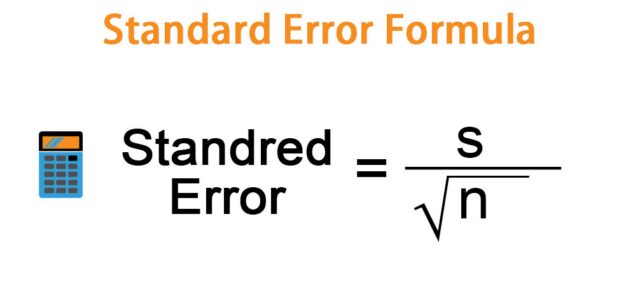

Formula:

| = | standard error of the sample | |

| = | sample standard deviation | |

| = | number of samples |

It has applications in the two insights and financial matters. It’s especially important in econometrics, where scientists use it to do relapse examination and speculation testing. It’s likewise utilized in inferential insights, where it’s the establishment for building certainty stretches.

In the discipline of measurements, a few routinely utilized measurements include:

- The standard deviation of the mean (SEM)

- The change standard Error

- The middle’s standard mistake

- A relapse coefficient’s standard Error

What is Rate of Change and how it is use, Read the complete Guide Here!

Distinction Between Standard Error Formula and Standard Deviation

Both standard deviation and standard mistake are utilized in an assortment of factual examinations, remembering those for finance, medication, science, designing, brain research, or different fields. A few examinations, be that as it may, once in a while stir up the SD and SEM. Scientists should remember that the SD and SEM gauges consolidate an assortment of measurable ends, each with its own significance. SD represents the standard deviation of individual information esteems.

What is max pain options and how it can be calculated, read the full Guide.

The standard deviation (SD) and assessed standard Error of the mean (SEM) are utilized in these investigations to give test information qualities and to clarify measurable examination results.

To put it another way, SD reflects how well the mean takes after the example information. Be that as it may, measurable deduction dependent on the example conveyance is remembered for the meaning of SEM.

Standard Error of the Mean

The standard deviation is separated by the square base of the example size to deliver the SEM.

The standard Error of an example implies is determined by working out the example to-test inconstancy of the example implies. As the example size becomes higher, the SEM decreases comparatively with the SD; consequently, as the example size grows, the example means all the more precisely addresses the genuine mean of the populace. The SEM demonstrates how exact the example mean is as an intermediary for the populace’s genuine mean. Expanding the example size, then again, doesn’t consistently make the SD more noteworthy or lower; rather, it turns into a more precise guess of the populace SD.

Along with Standard Error formula you have to know about other financial terms like marginal rate of substitution and monetary condition index.

Benefits of Standard Error

The standard error of the mean is just the standard deviation of the unmistakable example implied from the populace mean when various arbitrary examples are taken from a populace.

At the point when an example of information from a populace is removed and the example not set in stone, it is utilized to assess the populace implies. It is here that the Standard Error of the mean enters the image. The example means will likely contrast from the populace mean. It will assist the analyst with deciding how much assortment in their exploration.

Nonetheless, the analyst may not generally approach a few examples. Luckily, a solitary example might be utilized to process the Standard Error of the mean.

If you are a stock market trader or investor you should know about stop on quote and limit order. it will help you to maximize your profit and minimize the loss in your trading and investment.

Standard Error and Standard Deviation in Finance

The standard deviation of the return, then again, reflects how far individual returns go amiss from the mean. Subsequently, SD is a proportion of instability that might be utilized to survey the danger of speculation.

The standard error of the mean day-by-day return of a resource is a monetary metric that evaluates the precision of the example mean as a gauge of the resource’s for quite some time run (predictable) mean day-by-day return.

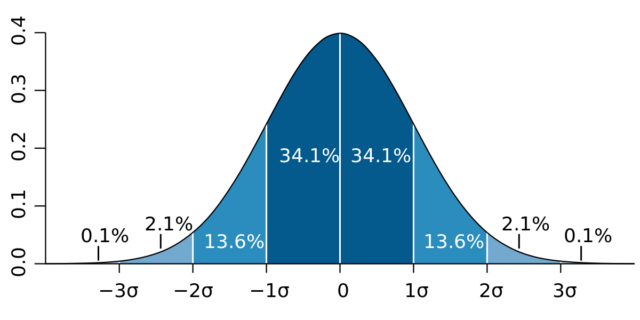

Resources with all the more day-by-day value changes have a bigger SD than resources with less day-by-day value changes. Accepting an ordinary circulation, around 68% of everyday value developments are inside one standard deviation of the mean, and roughly 95% are inside two SDs of the mean.

Last Words/ Conclusion

Standard Deviation can be productive whenever determined appropriately. We have given the most ideal information to assist you with understanding the Standard Error appropriately. Assuming you have any questions then, at that point, go ahead and reach us.