Introduction –

Buying a house is a big decision as it involves a huge amount of financial support. Most of us rely on financial assistance in form of home loans. A home loan is a loan that is taken to purchase a home by offering it as collateral. Here we discuss Top 8 Factors to consider while taking Home Loan, If you want to apply for a simple way to home loan then click here.

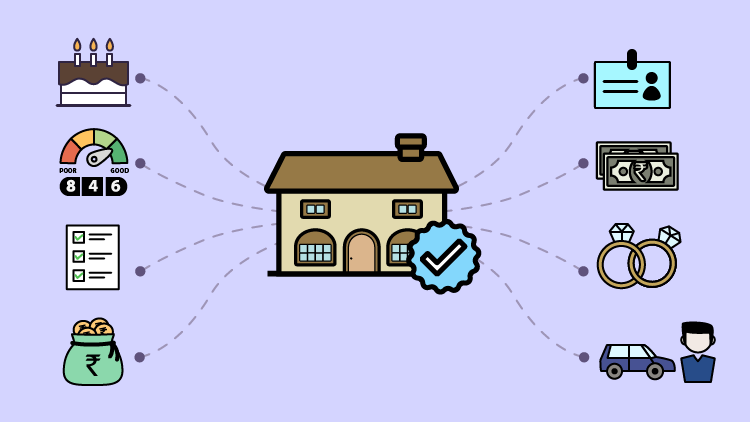

Following are the factors to consider while taking a home loan

Interest Rate

The interest rate of your home loan assumes a critical part in choosing whether or not to benefit from an advance and which moneylender to pick. We as a whole know that we ought to do intensive research prior to selecting the best moneylender. Aside from that, you ought to likewise know about the various kinds of the interest rate charged by the banks and housing finance organizations.

The following are types of interest rate

- Floating Interest Rate

- Fixed Interest Rate

- Hybrid Interest Rate

Want to know about rate of change formula? Read a complete guide here.

Loan Amount

Your loan amount influences a few things in the home loan. The rate of interest generally differs for the loan sum up to 30 lakhs, over 30 lakhs, and up to 75 lakhs, or more than 75 lakhs. Since a home loan is a drawn-out Commitment, it is fitting to select a loan sum that you will actually want to compensate easily for quite a while. Rather than settling on an advance sum that you are qualified for, you ought to loan amount just what you can bear to reimburse immediately or defaults as it can adversely affect your financial assessment and future credit qualification.

Tenure of loan

Generally, home loans are for a longer period of up to 30 years, depending upon your eligibility. If the tenure of loan payment is longer it will lower monthly payments but it will ultimately increase total interest payment. And in case of tenure is shorter it can lead to the burden of huge EMIs. Subsequently, it is advisable to pick the right tenure for a loan to make your month-to-month repayment smoother and save you from paying huge interest.

What is marginal rate of substitution and how to solve MRS, read a complete guide here.

Down Payment

Suppose you applied for a home loan of Rs 60 lakhs, and they give approval for Rs 40 lakhs on the basis of your eligibility. In this case, you will have to pay Rs 20 lakhs on your own. This amount that you pay in your pocket is called a down payment. You should make the maximum down payment as you can without stressing your budget, as it will help you to reduce your loan amount. The lower the loan amount, the lower the interest you will pay.

While trading stop on quote is an important factor to minimize your loss and stable your income, you should know about this before doing trading.

Documentation

Various documents are required for applying for any kind of loan. Most importantly the first thing that lenders will check is your credit score. A credit score is an indicator that tells a person’s Creditworthiness to repay a debt Amount. Documents can be categorized as

- KYC Documents

- Income Documents

- Property Documents

What is cpn and is it a scam or not? read a complete guide here.

Processing Fee

A Processing Fee is a fee that is charged by the lender for processing your loan application. These fees generally depend upon the loan amount as many banks charge processing fees as a fixed percentage of the loan amount. However, there are some lenders which offer flat processing fee rates irrespective of the loan amount.

Repayment Ability

A person should check his ability to repay a loan because the inability to repay the loan amount can have a negative impact on a person’s credit score. And even missing your monthly installment can cause some legal actions by lenders and can sell your property for reimbursement.

What is rule of 70 and how to implement it in financial goals, Read a comprehenesive guide here.

Pre-Payment Charges

Since purchasing a house is a major monetary choice for a great many people, large numbers of them are genuinely touchy about claiming an obligation-free home. Thus, they like to reimburse it straight away to pay off their obligation trouble. Pre-installments can either be part-installments where you make a singular amount installment towards the chief sum or abandonment where you reimburse the whole advance sum before the consummation of the credit residency. By making part-installments whenever the situation allows, you will actually want to save a significant sum on interest and become obligation-free before.