How to get out of debt: Top 10 ways to become Debt Free

Introduction

In today’s era, we all have so many needs and desires which we want to fulfill, and sometimes, just to accomplish these needs and desires, we fall into a lot of debt. Debts are your liabilities in the form of loans, borrowings, etc. which you are liable to pay. In most cases, people take loans to fulfill their desires, not for their needs. For example, If you are taking a loan to buy a car, then this is your desire, not your need because it’s not like you can’t live without a car.

How to get out of debt is one of the important thing which we have to discuss about personal Finance as if we have no debt on ourselves then we can use our finances properly.

Humans have a lot of dreams and we want all of them to be fulfilled. And for this, we let ourselves fall into the swamp of debts.

How do we get trapped?

We often don’t know how we get into so many dues, the following can be a few reasons:

Excessive use of credit cards

We don’t stop once we start using our credit cards but if we frequently use our credit cards without limits, this can lead us to severe debts.

Read a complete Guide on credit cards which helps you to do optimum utilization of Credit Cards.

Quick loans

Obsessions with ambitions force you to take quick loans. You don’t give a thought to how much you will need to repay.

Borrowings

When you purchase something, instead of paying on the stop, you often say ‘will pay later for this but when we calculate our total borrowings, it is near equal to a big loan.

All the above circumstances can be the reasons for your debts so you need to avoid them.

Why is it necessary to get out of debt?

Debts are responsibilities of debtors which they have to pay back to the creditors and, a person does not want himself/herself to be a debtor for a lifetime. So, it is very important to come out of all the debts by paying them off. There could be the following importance of getting out of debt:

No more liabilities

Paying off all debts in a short time period will give you so many future benefits. One of them is that you won’t have any liability unless you take other loans, etc. It means, there will be nothing you are obliged to pay.

Savings

If there won’t be anything to pay off, the amount of your savings will also increase. You can save extra which will be beneficial for you at any time.

How to save money Top 10 ways, Read the complete Guide here.

Investments

If you save more then you can invest more. Investing in share markets, mutual funds, or depositing money in bank accounts and fixed deposits will give you more income on your savings. It means you can earn by just investing your savings in the appropriate place.

Relief

Completing all the financial responsibilities at once will give you mental relaxation which helps you to enhance your performance at work. This will refine your skills and help you to present yourself more perfectly.

The golden rule

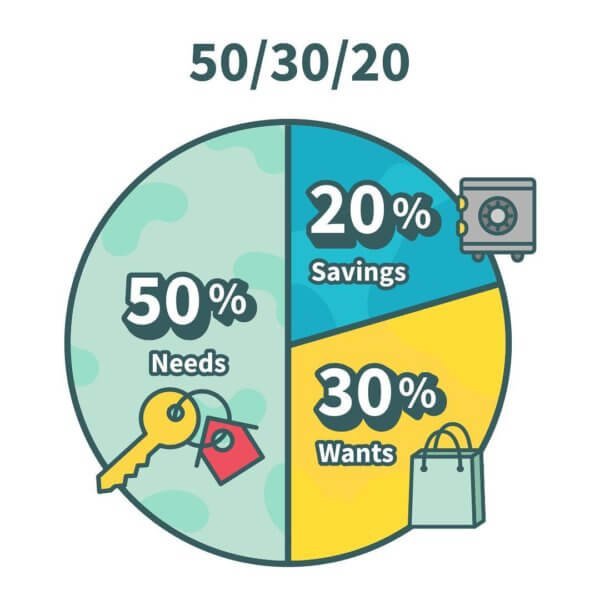

Spending without any pre-plan will not let you come out of your debts. Hence, you need to plan your expenditure and will have to act accordingly. To spend your money, you should always follow the golden rule of budgeting which is the 50:30:20 rule. According to this rule, one should segregate the income and expenses into 3 sections:

*In the first section, all the basic and unavoidable needs should be included. And for these expenses, you should keep 50% of your total savings. Basic needs can’t be avoided and that’s why we keep half of our total income for these expenses.

*Everyone has some desires which they want to fulfill, so after deducting half from our total income, we have to keep 30% of the remaining income for our desires and wants.

*At last, what you have is 20% left of your income. You have to either pay out your debts from this or if you don’t have any debts, then this is your ultimate savings.

Read a Complete Guide on 50-30-20 rule in the how to budget Money Article which helps you to give a detail about this.

Top 10 Ways to be debt-free

Essentiality

At first, you need to identify what are the things that are essential to you. Extreme needs like food, clothes, shelter, education, etc. will be included in this. You should only consider the things as an actual expense without which you cannot live. This will help you to minimize expenses and you’ll be able to pay more debts.

Read a complete guide on Money Management which provide you best tips to manage your money.

Set the priorities

After the deep needs, here come the general needs such as transport, mobile phones, etc. But, in general needs, you have to prioritize what is truly necessary. You have to identify if you are including some of your desires into your needs. So, you need to see all these aspects very minutely to figure out what is a need. Through this, you can remove unnecessary expenses and will spend only on genuine needs.

Budget

After going through both the above steps, you need to draft a budget that suits both your income and expenses. List your total income and expenses, assign a particular amount for each category of expenses and follow it properly. Also, compare the expenses of the previous month to the present month to know the fluctuations. Budgeting will help you to analyze every possible way to come out of dues.

Side work

Along with your main job/work, you should start doing some side work as well. For example, if you know graphic designing then you can work as a freelancer by making your profile on several platforms like Fiverr, Upwork, Glassdoor, etc. All you have to do is just create your profile, add your experience or knowledge, browse opportunities, approach them and start working. This way, you can earn extra money which will help you to clear your debts.

How to make money fast, A Complete and Comprehensive Guide to read.

Do not overspend

It happens when you are out shopping and you purchase useless things along with the needful things. You have to hold yourself back at such times because it will affect your budget adversely. Overspending can ruin all your thoughts of saving money. If you can’t save, you can’t get free from your debts. So, do not spend too much on anything.

One big loan

If you have more than one small loan over your head and you have to pay different amounts of debts with different interests, then you can apply for one big personal loan. After getting a big loan, pay all the small loans at once. This will make you free from managing different loans and you only have to pay a fixed installment with a fixed interest rate.

Reselling

We all have a few things in our house which we don’t need but still have to keep because we have bought them and can’t throw them. In such situations, you can resell those items which are not useful to you but can be necessary to someone else. You will get money by selling them and others will get profit by getting second-hand things at fewer prices.

Read a complete guide on swagbucks.

Unexpected money

Unexpected money such as bonuses, increments, monetary motivation, appraisal, etc. can be a big financial support to deal with your debts. If you have a small debt amount, then you can immediately pay it from this kind of money and if you have big debts, then you can mix the amount in the rest of your savings to pay it later.

Keep a check

You need to check the inflow and outflow of your money timely to avoid fraud and shortage. Keep an eye on each expense and compare utility bills each month to know how much you are saving and how much spending. This will show how concentrated and dedicated you are towards paying off your debts.

Consistency

If you want to be free from the burden of debts, then you need to work as per the budget, have to follow the 50:30:20 rule, and should maintain consistency in saving money. For example, suppose you performed well for 2-3 months and then you stopped working as per your budget, so this will not help you in any way. You have to be consistent for at least 7-8 months to get desired results.

Conclusion

Paying off all the debts at once may sound easy but it is a tough process to get rid of debts. If you want to reduce your debts completely, there are a few qualities needed such as strategy making, concentration, making a perfect budget, dedication and consistency. After all these qualities, what you need the most is patience. Being impatient and quitting the whole plan will give you nothing. So, do not panic, focus on the core and work for the desired end which is, to pay the debt on time.

Frequently Asked Questions(FAQs)

1. What’s good in paying debts at once?

Ans: This will increase your savings, will open new investments opportunities, and will give you mental peace so that you can focus on other things as well.

2. Should I save money or pay debts?

Ans: You cannot save money without paying debts because whatever you save, you will ultimately pay it as installments and interest on your loans. So, if you want to save money, then you will have to clear your debts first.

3. Will my savings completely wipe out in paying debts?

Ans: Well, it depends on how much amount you have as debts. If you are saving money for a long time so after paying debts, you will have surplus savings in your account.

4. Is being debt free the new rich?

Ans: Yes, If you don’t have any type of debt then you can save and invest that Money and can make money by investing so it will help you to compound your money and make you rich.