Stop on Quote: Limit Order, Difference Between Limit order vs Stop Order

Introduction

While trading, it is essential to decide your orders wisely. Investors and traders must analyze and observe the market before placing an order. It is equally essential for the trader to understand the types and differences between different types of orders. Orders in simple language allow you to govern which stocks you wish to trade. You can put orders on the stocks you find best suitable stocks according to your requirements. One of them is stop on quote order.

If you don’t find the available market price of a specific type of stock, you can put a limit order or stop order to your broker, indicating them to stop filling your trade with these stocks at a particular price. You can quote a specific price for the stocks in your possession with your broker. Whenever the current marketplace matches your quoted price, the stocks can be sold. To make an appropriate and most beneficial order, you must know the difference between them so that you can analyze your situation and utilize your powers as a trader. So, here’s a complete guide for you on what Stop on Quote order is and how to implement it.

Here are the Best Investment apps in 2024 to make your investment better.

Types of Orders

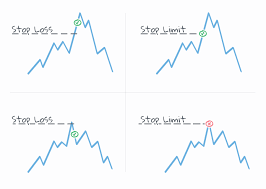

To understand the difference, you need to make sure that the limit order, stop order, or stop-limit concepts are clear for you.

Limit order

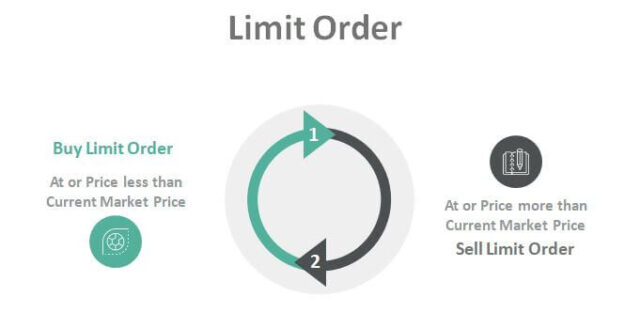

A limit order can be understood as the least amount at which the trader can buy or sell your stocks of a particular type. You can put different limit orders for different quantities of the same type of stock. The limit order price set by the investors needs to be set below the market price of the current stocks.

Traders or investors are not allowed to set a plain or blunt limit order on stocks that is lower than their current market price. This is because the market offers a more reasonable and better price for the stocks than your listed price. Also, it can be used to sell your stocks at the price you find most suitable. It can be slightly or majorly less than the market price, which can attract buyers to your stocks. Know more about what is limit order.

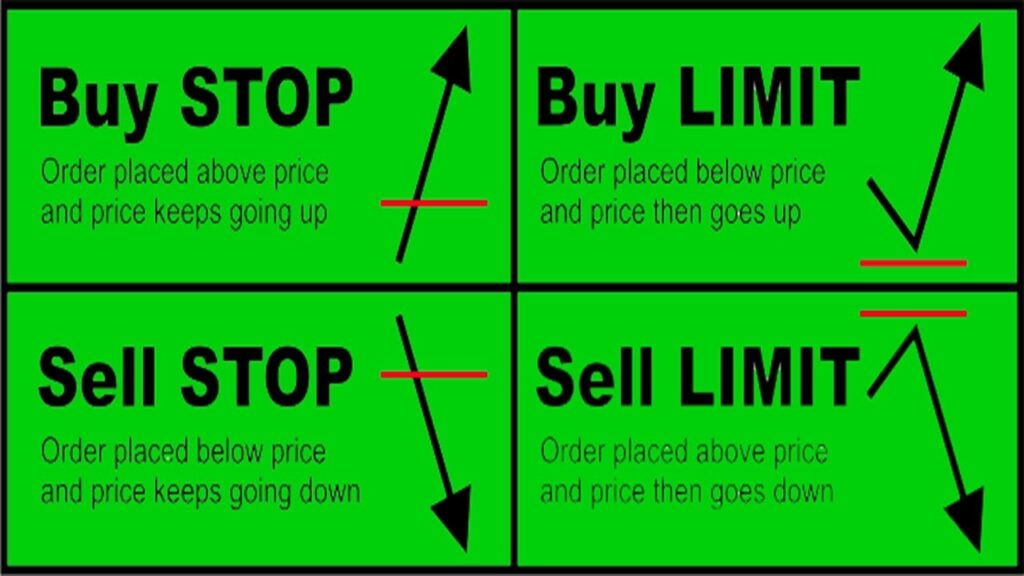

Stop order

Stop orders are a way for traders to put forward a price that is still not available in the market. It provides a conditional order on the stocks at higher prices than the current price while the order is placed. Your broker can sell the stocks whenever the market offers a price somewhere near the price you mentioned.

Only then the stop will trigger and raise the prices to the desired amount. Since there are various types of stop orders, their execution and application by the trader depend on the type of stop order. The most recent and widely used type of stop order is the stop on quote type.

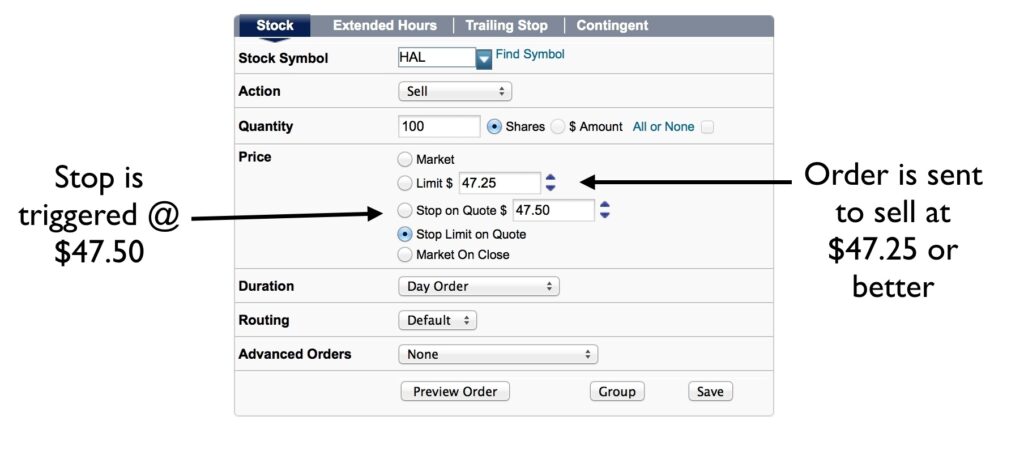

In case the broker or trader applies the stop on quote type of order on particular stocks, it provides clarity to the buyers. It indicates that the stop order will generate and rise only when the current market price of the stocks are matched with the price at the initial stage. The stop on quote allows the trader to invoke the benefits of the limit order combined with the stop order. Stop on quote provides the brokers with the best price ensuring the conditions of stop and limit orders are met effectively.

how to make money fast, Here is the complete Guide.

On the other hand, if a standard or only stop order is applied, it will convert into the simple market order once the price is matched with the raised price by your stop order. You can also set a stop order when you are willing to enter the market. This will help you initially put a stop order to trigger the prices when the market is high. Once the current market matches the price you initially put forward in the stop order, it will be converted into a traditional market order and yield appropriate rates.

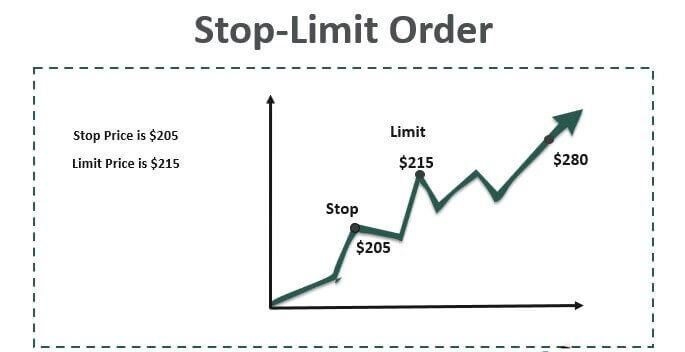

Stop limit order

Stop limit order contains announcement and deciding two prices. The trader puts this type of order by giving out both limit order price and stop price. The working principle of this order combines both as the limit order is invoked once the current market price is met with the stopping price mentioned by you. Traders or investors can get benefited from this order for both selling and buying stocks.

Read the full guide to how to make money writing? here.

Another benefit is that the limit order is automatically applied once the price matches your quoted price. If the price is lower than the limit order price quoted by you, the limit order is not invoked. The significant risk associated with stop limited order is that traders can either fill partially or a total loss by no filling. Thus, the risk factor in stop v/s limit order is less than stop-limit order. The investors must think through before putting out a stop-limit order.

Limit Vs Stop Limit Order

While understanding the limit vs stop limit scenario, two significant differences come into sight. The first and foremost difference between limit and stop orders is price announcement. The limit order helps the trader announce Or put forward a specific amount at which they will sell the stocks. It is the least acceptable price on a certain quantity of stocks that can match the marketplace, or the trader will wait.

Read the full guide on how to make money from home.

On the other hand, stop order is simply the margin boost traders request once the stocks are already at the selling edge. It gives the trader a slight boost in selling price but hardly affects the market. The actual order remains nearly the same after putting the stop order.

The second significant difference between limit vs stop order is accessibility. When a trader puts on a limit order on a specific type or quantity of stocks, it is available and visible to the market constantly. However, this is not the case for a stop order. The market can access and notice the stop order only after it is triggered since it is the last moment. The stop order is not visible to any of the market traders before it’s triggered. The market traders looking for constant updates on the price of stocks will see only limit orders, not stop orders.

Whereas when a limit order is put on particular stocks, The stocks will be sold at the mentioned price only. To make it more beneficial, traders can put a stop-limit order. In this case, where the traders put a stop-limit order on particular stocks, a limit order is applied at a price changed or raised by stop order.

How much money you can make on Youtube, Read Here

While using a stop limit, traders can quickly put a minimum or least selling price of the stocks at a price raised by putting out a stop order. While putting a stop order, if the market price is boosted or changed because of the stop order, the market order is placed finally. Therefore, the traders need to simultaneously set a limit order price and a stop order price while putting a stop-limit order. However, the limit order price and stop order price decided by the trader doesn’t need to be the same.

These significant differences between a limit order and a stop order are vividly noticeable and understandable by the market and traders. The traders can choose from stop order, limit order or stop on quote orders according to their requirements and market situation.

How does the stock market work, Read full guide here.

However, all the orders hold unique pros and cons when studied individually. Generalizing orders is not possible as each broker’s requirements and needs are different from the other. The trader needs to select what order they want to put for different quantities and types of stocks.

Therefore, selecting and using the best kind of order from various types depends on the skills and situation of the broker. Investors must study the market and forms of order to make a good and fair decision. This will help you to gain profits and kick out the guessing game from your stocks trading process.

Conclusion

So, this was all you need to know about stop on Quote order. We have tried explaining it to you in detail for your help. We hope that this has helped you.

Frequently Asked Question

1. What does Stop on quote limit order mean?

Ans: Stop Quote limit order is a combination of both a stop quote and a limit order. Sell order for stop quote limit order is placed when the price is below the stock’s current market price, and it will trigger when the price is lower than the decided price.

2. Is it possible to sell or buy the same stock?

Ans: When it comes to retail investors, you will not be able to sell or buy a particular stock on the same day for not more than four times in five business days.

3. Is day trading illegal?

Ans: No, Day trading is not illegal but, it is extremely risky, and therefore, it is not advised. This is to protect the capital invested by the investors.

4. Can I buy a Sold stock again?

Ans: If you have sold a particular stock, you can surely repurchase it. There is no such rule where you can not rebuy the stocks that you have sold.