Want to know about Credit Cards? How to use Credit Cards, How to earn from Credit cards?

If you are going through a financial crisis, then a credit card can be one of the best options to manage your finances. You can borrow money for shopping, food, or anything and repay the amount after a certain time. Also, there are several benefits that you can enjoy if you make the best use of them. If you don’t know much about credit cards, read this article until the end.

What is a credit card?

A credit card is a credit facility offered by banks, allowing clients to borrow money up to a pre-determined credit limit. Credit cards require cardholders to repay the borrowed funds, plus any applicable interest, as well as any extra agreed-upon charges, in whole or over time by the billing date. It allows people to buy goods and services online.

The credit card provider sets the credit limit depending on criteria, including income and credit score. A credit card’s biggest feature is not connecting to a bank account. As a result, when you swipe your credit card, the money is debited from your credit card limit rather than your bank account. The credit card number, cardholder’s name, expiration date, signature, and CVC code are all included in the credit card information.

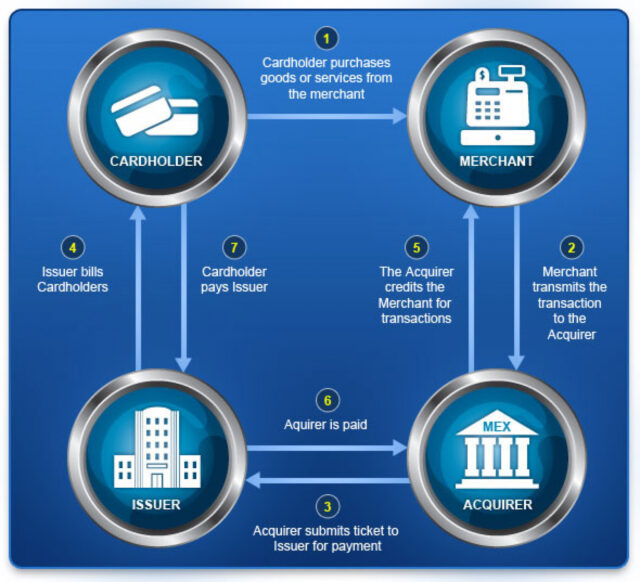

The functionality of Credit Cards

Credit cards may be used to make online and in-store purchases and make payments. When you pay with a credit card, your card information is sent to the merchant’s bank, and the bank then requests authorization from the credit card network to complete the transaction. Before accepting or refusing the purchase, your card issuer must check your information.

If the transaction is approved, the merchant is paid, and the transaction amount is withdrawn from the available credit on your card. At the conclusion of each billing cycle, your card issuer will send you a statement that includes all transactions for that month, your prior and new balances, the minimum payment required, and the due date.

The buffer period is the time between when you make a transaction using your card and when your bill is due. If you pay your account in full by the due date within this time, you will not be charged interest.

want to know about what is nft, read here!

On the other hand, your card issuer can charge you interest if you carry debt from month to month. The annual percentage rate (APR) on your credit card represents the expense of holding debt on a yearly basis. Your annual percentage rate (APR) covers both your interest rate and additional fees, such as an annual fee if your card has one.

Methods To Earn From Credit Card

Here are some of the best ways through which you can earn credit cards.

- Try to Avoid Using Cash or Debit Card.

- Defer paying your credit card bill until the very last minute.

- Increase your credit payment cycle by negotiating.

- Reward Points

Best Tips To Use Credit Card In 2024

Making sensible financial decisions should be at the top of your agenda for the new year, whatever it is you desire. Here is some helpful credit card advice for 2024 to help you get the most out of your money.

Take Advantage of Free Money

While we’re on the topic of free money, make sure your offers are optimized. Credits on many cards, including numerous higher-tier American Express cards, reset every calendar year. Failure to use up your credits each year might result in hundreds of dollars being wasted over time. While it is too late to utilize credits for 2024, you may begin using credits for 2024 right away so that you are not caught off guard at the end of the year.

Check for a retention offer

Make a note of your card renewal dates immediately. Set a reminder to call 30 days in advance to ask for a retention incentive because your calendar is currently open with a reminder to check your cards for offers. As banks compete for your business, a five-minute phone call might result in hundreds of dollars in incentives. And, if you don’t get what you want, you’ll have time to consider if you’re going to pay the annual fee to maintain the card before it’s too late.

Manage your Limit Properly

Now is an excellent opportunity to review your present credit cards and determine whether they match your spending habits from the previous year. With many sorts of travel still being hampered by the epidemic, you may find that your 2024 plans still entail less spending on the road and more spending at home.

Excessive consumption during the holidays may put a burden on more than just your waistband. If that’s the case, you’ll probably spend more on groceries, takeaway, and petrol while spending less on travel and dining out. It can make sense to trade in a pricy airline or dining rewards card for one that offers high points on groceries and petrol.

Avoid any Previous Debt.

If you’re in debt, especially on a high-interest credit card, the New Year can help you get back on track. A balance transfer card may be useful for paying off debt without incurring additional interest costs. With a balance transfer card, the best objective is to pay off the full debt within the promotional period if at all feasible.

Look for Cashback every time you make a payment.

Only getting far more Cashback on your credit card spending beats getting a cash return on your credit card spending. You may simply achieve this by purchasing online using your rewards card and a cashback gateway. Rakuten.com and BeFrugal.com, for example, will pay you Cashback for purchasing as you normally would. You can increase your savings on most of your online purchases by stacking this reward with what you’d earn from your credit card.

List Of Best Credit Cards in 2024

What does a great bank card look like these days? The bank card industry is competitive and constantly changing. Currently, this means new playing cards that provide customers with more options. Bank card users may want to know what to look for if this trend continues through 2024. Annual fees, sign-up bonuses, rewards fees, and zero percent interest offers have long been benchmarks for assessing and comparing credit cards.

However, several issuers have recently begun offering specialty cards with benefits tailored exclusively to consumers interested in bitcoin, wine, or video games. Here is the list of factors that needs to be considered:

Reward Points

Card issuers have traditionally governed how you earn points in the first place. For a long time, bank cards have offered various options to redeem rewards, including Cashback, a statement credit, goods, gift cards, and point transfers to airlines or hotels. This is changing as more playing cards allow you to tailor rewards to your spending. You can control which classes get the highest prizes by using these playing cards. If dining out is a factor for you, for example, you’ll choose restaurants as your bonus category.

Pay Later Service

More shops are allowing customers to pay for products over time in a set of fixed amounts, usually without interest. Even with bank cards, the notion of paying over time without incurring interest, such as layaway, is not new. Bank cards have long enabled you to pay later if you pay your bill in full each month, and this is because you may have a built-in grace period of several weeks before needing to pay your bank card invoice.

High Credit Score

Curiosity is built into these funds, most likely at a lower rate than your bank card’s standard rate of interest. It’s advantageous to have a large credit score line on a credit card. However, in the past, a bank card wasn’t a great way to access fast cash because the only way to do so was to take out a pricey cash advance. Unlike a traditional private mortgage, you do not need to qualify because you have already been approved for the credit line. There is no official mortgage application, no additional account to manage, and no time-consuming credit check.

Based on these factors, here is the list of best Credit Cards in 2024:

Credit Card – Advantages and Disadvantages

If you’re new to the world of credit, here’s a rundown of the benefits and drawbacks of using your small plastic card. With its ease of use and flexible payment choices, a credit card has become an integral part of our life. A credit card’s discount offers and deals are unrivaled by any other financial instrument, making it a gold mine for the savvy consumer. On the other hand, credit cards can become debt traps if not handled properly or if you spend more than you can afford to repay when the bill arrives.

Advantages of Credit Cards

Easy Option for Credit:

The most significant benefit of a credit card is the ease with which it may be used. Credit cards work on the principle of delayed payment, which means you may use your card now and pay for your purchases later. The money used does not leave your account, so you don’t have to worry about depleting your bank account every time you swipe.

Establishing a credit line

Credit cards allow you to build up a credit line, which is critical because it will enable banks to see your active credit history, which is based on your credit card repayments and use. Banks and financial organizations frequently use credit card usage to assess a potential loan applicant’s creditworthiness, making your credit card vital for future loans or rental applications.

Access to an EMI facility

You might opt to place a major purchase on your credit card as a means to delay payment if you don’t want to spend all of your funds on it. Furthermore, you have the option of paying for your item in equal monthly payments, guaranteeing that you do not pay a large sum for it and depleting your bank account. Paying through EMI is less expensive than taking out a personal loan to pay for a large item like a mobile or a car.

Disadvantages of Credit Card

Due diligence trap

The minimum due amount stated at the top of a monthly statement is the largest disadvantage of a credit card. Many credit card users are misled into believing that the minimum payment is the entire amount owed. In reality, it is the smallest amount that the corporation requires you to pay to continue obtaining credit. As a result, clients mistakenly believe their bill is modest and spend even more, incurring interest on their outstanding balance, which can quickly balloon into a big and unsustainable sum.

Costs that are not visible

Credit cards seem to be easy and uncomplicated at first glance, but they include many hidden fees that may quickly add up. Late payment costs, joining fees, renewal fees, and processing fees are just a few of the taxes and fees that come with credit cards. Missing a card payment can result in a penalty, and making many late payments can result in your credit limit being reduced, which can hurt your credit score and future credit chances.

A high rate of interest

If you do not pay your bills by the due date, the balance will be carried forward, and interest will be applied. Over time, this interest accumulates on purchases made after the interest-free period has ended. Credit card interest rates are relatively high, with an average of 3% each month, or 36 percent per year.

Conclusion

So, if you are thinking about getting a credit card for yourself, consider these things before opting. A credit card can be useful in various ways, but you have to be very careful while using it. We hope we have helped you enough to understand every aspect of it. If you still have any queries, then feel free to contact me.

Frequently Asked Questions

1. What are the benefits of Using a Credit Card?

Credit cards may be useful tools for earning rewards, traveling, handling crises or unanticipated spending, and improving credit when used carefully. A rewards credit card does exactly what it says on the tin: it pays the cardholder for purchases, and rewards differ depending on the issuer and card type.

2. What are the tips for Beginners to Use Credit Cards?

Points to Remember When Using Your First Credit Card

- Set a budget.

- Track your purchases.

- Set up automatic payments.

- Use as little of your credit limit as possible.

- Pay Your Bill in Full Every Month.

- Check Your Statement Frequently.

3. What is the biggest disadvantages of using a credit card?

Overspending: A credit card may be a dangerous weapon for people who cannot control their need to spend money. The ease with which credit is made available not only alleviates the pain of making a payment but also increases their urge to buy or consume more.