What is TAN? TAN Number, Difference Between TAN, PAN and TIN Number ?

Introduction

There are a lot of options available for us about which we are not aware enough. There are a lot of schemes introduced by the government that hold the capacity to change situations but because we don’t know about them, we miss the chance. But, being aware of these government instruments and policies is necessary. TAN is one of them. So, let’s understand what a TAN (Tax Deduction Account Number) actually is?

What is TAN Number?

A TAN is a 10 digits unique id, issued by the government of India. This id consists of both alphabets and numbers. All those people who are bound to collect or deduct tax at a source must have this number. In the IT Act of 1961, as per section 203A, if you are returning the TDS, then the TAN number must be stated on it. Full form of TAN Number is Tax Deduction Account Number .

what is investing and how to invest, read complete guide here.

Importance of TAN?

Knowing your TAN number is important if you have filed or are about to file your income tax returns. According to the Section 203A of IT Act, 1961, here are some following reasons to get your Tax Deduction and Collection Account Number:

*If you want to file Tax Collecting Source or Tax Deducting Source, then you have to get your TAN number. Without this, filing TCS and TDS will not be possible.

*If you are looking for Challans for your TCS and TDS payments, then you also need your TAN id.

*You are not allowed to submit TDS or TCS certificates without your TAN number stated on it. Even if you do so, then your documentation will be considered invaild and there can be penalty charges on you as well.

*You cannot submit any sort of forms related to Income Tax without your TAN number.

Read a complete Guide on Personal finance to become more wealthy.

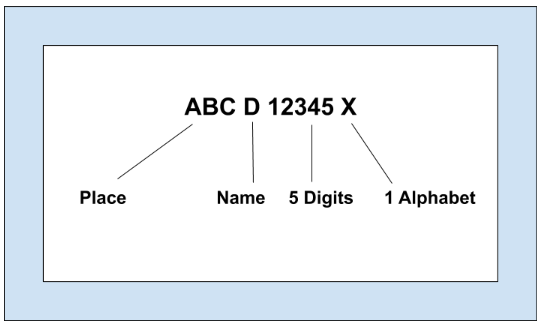

Format of TAN number

TAN number has gone through various changes over the past few years. Its current format has ten digits- the first four digits are alphabets, the five numeric terms, and one more alphabet at last.

*First 3 alphabets denote from where the holder belongs to.

*The 4th alphabet is the initial of the holder’s name.

*Then 5 numbers are unique id.

*And the last alphabet is also a part of the unique id.

Let’s understand this with an example,

Suppose Mr. Prakash who lives in Gujarat has applied for a TAN number. So, his id will look like-

GUJP33300J, in which

*GUJ are first 3 characters of the place where he lives i.e. Gujarat.

*P is the first initial of his name , Prakash.

*Next are 5 numeric digits (33300) which is a unique id, decided by the IT department.

*And at last, there is one alphabet (B) at last which is also a part of the unique id.

What is money management and how to manage money better, read a comprehensive guide here.

Characteristics and Types of a TAN number

*If you are giving salaries, commissions, dividends, etc. then the TAN number is mandatory for you to have.

*This is also important if you are filing for tax returns.

* If the person who must have a TAN number does not have it, then there is a penalty charge of rupees 10,000 on him/her.

-Generally, there are two types of TAN applications:

- First one is the application to issue a TAN number.

- And, the second one is to change or edit the existing TAN number.

How to save money to make your life better. Learn here the best ways to save money.

People who can apply for TAN ?

TAN number is required to all those who pay salaries, commissions, or any sort of written amount. Along with government authorities, the autonomous institutions, companies, organisations, and all other businesses are also bound to have this number.

Process to apply TAN?

Just like other processes, this also has two modes to apply i.e. offline and online. If you want to apply offline then you have to fill out Form 49B and submit it to any TIN Facilitation Centres. As per the norms, if an unregistered company is applying for TAN, then the form would be INC-7. You are then supposed to pay the required fees through any mode.

what is swagbucks a complete and comprehensive guide.

Offline Mode

If you are choosing the offline mode, you can either pay through cheque or through demand draft. Generally, it’s hard to obtain a 49 B form. Here are a few ways to get the form:

*You can download it from the official website of the Income Tax Department for free.

* You can also get this from any TIN-FC centre.

* And a photocopy is also acceptable at all the centres connected to this.

After submitting the form, you will get your TAN id once the application request will be accepted and processed. You do not need to submit any documents in offline mode but in online mode, you need to duly sign the acknowledgement form.

Online Mode

In online submissions, first, you have to visit the NSDL-TIN website and have to fill out the application form. Then, you have to pay a certain amount of fee which is rupees 65. Then you will receive a document of acknowledgement, you have to get a printout of it and have to sign it. You are supposed to send it to the NSDL office within 15 days of online registration. This takes around 5 working days to complete the process. You can make payments through net banking, credit cards, or debit cards in online mode.

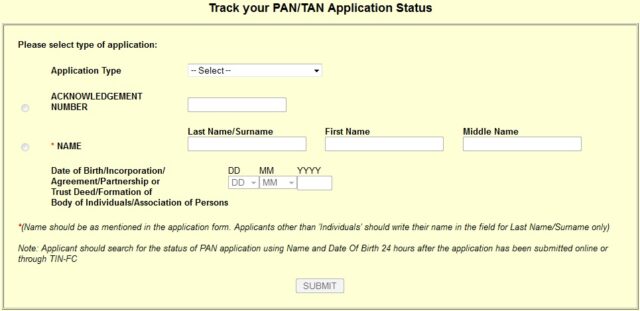

Track the application

If you have applied for the TAN and are now willing to track your application you can make this possible through the following ways:

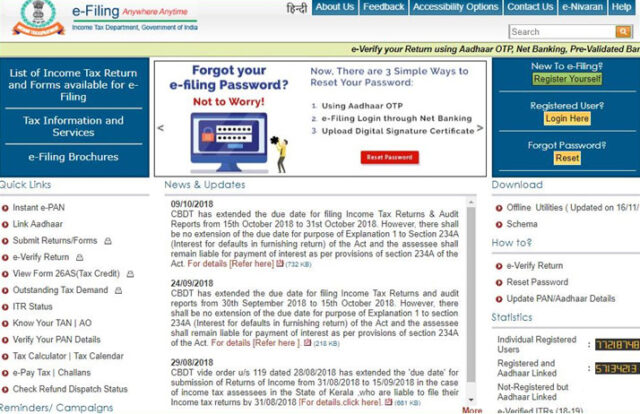

*First, you have to visit the official website.

*Choose the TAN option.

*Then select the option ‘know the status of the application.’

*Choose the applicant type.

*Enter your acknowledgment number.

*Enter captcha to verify you are not a robot.

*Submit the query.

What if you miss?

In case a separate entity has lost his/her id, you can easily get details online through the following steps:

*Go to the website of the IT department and log in. After this, click on ‘Know you TAN’.

*On a new page, a TAN search will appear where you have to select the name.

*Select the deductor’s category.

*Choose your state; enter your name and mobile number.

*Click on Continue.

*Enter the One Time Password sent to your phone.

*After clicking Validate, the details will be displayed.

Comparison chart between TAN, PAN & TIN

Whenever you enter the universe of tax, you always find the term TAN, PAN, and TIN. So, let’s understand what they are and how they are different from each other. Here is a basic comparison chart for you to understand:

| Basis | TAN | PAN | TIN |

| Issued by | By Income Tax Department | By Income Tax Department | By Income Tax Department |

| Structure | A 10-digit unique identification | A 10-digit unique identification | This consists of 11 characters. |

| Usage | For all sorts of financial transactions | This makes the TDS process user-friendly. | Issues to businesses to monitor transactions. |

| Necessary for | For all those who play a role in collecting or deducting tax. | For all those people who pay tax. | For all those enterprises who enroll for VAT. |

Government initiatives

There are so many issues faced by people if they want to get these IDs. But, now if you want to bring any changes in your IDs such as editing of some given information, anyone can bring the official website of NSDL and change any information.

Government has taken a step further to ease the situation. Orders have been issued by CBDT and Ministry of Corporate Affairs to make one single form for the application of TAN and PAN.

For the above problems, a proposal for issuing single form SPICe or form INC-32 has been made. All these efforts are meant to provide an easy atmosphere for businesses to develop in India. Government wants to help these businesses to grow and to encourage startups to nourish.

Frequently Asked Questions(FAQs)

1. From where will I get the details about TAN?

Ans: Everything has been mentioned in the form.

2. Is there any amount to pay for TAN?

Ans: Yes, you have to submit the required fees.

3. Through which can I make payment?

Ans: Credit cards, Debit cards, Net Banking, Cheques, or Demand drafts.

4. How will I receive my TAN number?

Ans: The NSDL will send you an official letter stating your TAN number.

5. Do I need any documents for this?

Ans: You do not need any document in offline mode. In online mode, you need to sign an acknowledgment letter.

6. Can this be done only offline?

Ans: No, there is an online option as well.