All about Personal Finance: A Complete Guide which make you more Wealthy.

Introduction

If you want to survive in this world, want to fulfill your needs and desires, then all you need is finance. But, handling money is a more crucial step than earning them.

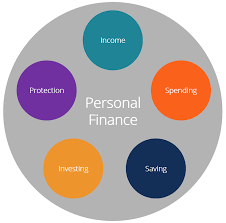

What is personal finance

Personal finance is just one type of finance. It consists of all the methods, values, and importance of managing money. From analysing the weekly budget to asset planning, everything falls under personal finance. It is like financial planning which can either be short or long term. If you have monetary literacy, it will be easier for you to understand savings, investments, budget planning, etc. All you need to know is some effective ways and methods to keep your financial status healthy.

Vitality of personal finance

From saving money in piggy banks to investing them in the share market, personal finance is important for each age group. This deals with all the four major aspects of life i.e. income, expenses, savings, and assets. Let’s understand this furthermore:

- Personal finance helps you in your overall development. It gives you a good knowledge of managing day to day’s expenses and extracting savings out of them.

- If you have a stronghold over the knowledge of personal finance then there are so many employment opportunities as a finance guide or as a finance counsellor.

If you are a student and want to know about best credit cards for students of 2024, Here is the Guide.

Implementation

Understanding personal finance and its practical application isn’t something that can be taught theoretically. Just like a diamond, it needs time to polish your financial knowledge. As the experience increases, your command over money-related affairs will also increase.

To give it a start, all you need is a bit of knowledge and a will to learn. This is the only way for its effective implementation.

LIC IPO is coming and here is all things you must know about LIC IPO.

Personal finance course of action

To keep your monetary conditions healthy, there are a few steps to be taken:

- Earnings

- Budgeting

- Monthly expenditure

- Loans

- Insurance Premiums

- Expenses in assets

- Taxes

- Paying debts

- Ultimate savings

- Investments

- Keep yourself updated

Earning

Doing jobs or businesses share the same motive, which is to make money. Earning money is the first step to doing financial planning or maintaining personal finance because what will you manage if you don’t earn? Money can be earned through the following ways:

- Jobs: This is the most basic way to earn money and more than 50% public depend on this for their earnings. There are a lot of jobs available around us differentiated on a various basis so that everyone has jobs of their choice.

- Businesses: The motive behind doing business is to earn a good amount of money. If you want to do something of your own, want to earn a huge amount in a comparatively short duration, and are ready to invest, then there is no better option than doing business.

- Interests: Interests are small but valuable financial inputs. You can either earn interest on your amount saved in the bank or can get it from the money people borrowed from you.

Here are the best business ideas for college students through which you can make you life.

Budgeting

After earning money, creating a budget is the next crucial step. A budget can be made by the following things:

- Prioritizing: At first, you need to prioritize those expenses which are unavoidable and are extremely needful.

- Excluding: We should exclude those expenses which are not so important right now, and at last, after making all necessary expenditures, if you have money then you can use them for these expenses.

Monthly expenditure

This is the most basic type of expense. Keeping a part of our total earnings aside for this expense is the initial step of making a budget. You can learn about monthly expenditure and budgeting in Money Management here is the guide. The following things are included under this category:

- Groceries: This is the most important expense in a household. This is a completely unavoidable expense because the food which is vital for living falls under this.

- Electric bills: Shelter is another crucial element of life. Nowadays, we all need electricity in our homes and for that, we need to pay electric bills.

- Petrol: In today’s era, everyone has at least one vehicle, and for that, keeping a part of total earnings for petrol expenses is important.

Loans

Loans are another crucial expense everyone has. Following are some types of loans:

- Home loans: Sometimes, to build our dream home, we take loans. Paying them back is a liability and an expense that we can’t ignore. Finding the best home loans offers can affect your expenses in a good way.

- Vehicle loans: The loan we take at the time of buying any vehicle (can be 2 wheelers, 4 wheelers, or anything else) is called a Vehicle loan. Comparing a lot of options can help you to find the loan which suits your need best and is pocket-friendly.

- Education loan: When funds are the only obstacle in our further studies, either in your homeland or outside your country, we take education loans. Although not everyone requires this, still those who want this need to go through all the possible options and find the perfect one.

Insurance premiums

To avoid uncertain incidents, insurances are necessary. These are not regular but notable expenses and deducting them from our income is also important to get our net income. Some important types of insurance that need to pay on time are:

- Health Insurance: To avoid uncertainties, taking health insurance is vital. And just like this, paying premiums of the insurance is also important and we consider this as an important expense. You can get insurance up to 1 crore by analysing the scheme of different companies.

- Vehicle Insurance: Before getting our vehicles insured, we need to find the best option which gives us the best possible results.

Expenses in assets

Just like insurance premiums, this is also not a regular but vital expense to count. This includes:

- Furniture: We don’t buy furniture very often, but whenever we do, it leads us to a huge unexpected expense.

- Lands: Permanent properties including lands and buildings are occasional expenses but huge and after the purchase, we have to pay loans( if any).

- Livestock: Keeping animals sounds easy but when we purchase them, we get to know their real worth of them because they are expensive. This includes goats, sheep, and many more.

Taxes

There are a few taxes which we are bound to pay. Generally, these expenses are counted as a yearly expense but we have to give a fixed percentage of amounts every month once a year.

- Income tax: If you are earning a taxable income then you have to pay tax. One part of your income is deducted every month which you pay annually to the government.

- Property tax: If you are owning a property then you are bound to pay property tax. Like income tax, this is also a yearly tax.

Paying debts

Apart from loans, there are still some debts like borrowed money, etc. In many cases, we have to pay a particular amount of debt with interest monthly so we can consider it as a regular expense.

Ultimate savings

After reducing all the above expenses from our income, what we get in hand is our net income. We assume that we have already reduced all the expected expenses and thus, we call this ultimate income.

Investments

After getting our net income, we will invest it in suitable places like share markets, mutual funds, SIPs, fixed deposits, etc. by considering the security and the amount of return on investments.

Here are the best investment apps in 2024.

Keep yourself updated

After doing these steps, all you need to do is to keep yourself updated about the new market policies and new areas of investment. This will help you to enhance your financial knowledge and guide you for further investments.

Ethics of personal finance

If you don’t want to face any financial crisis, then you should follow a few ethics of personal finance:

- Look into your expenses and try to reduce those which seem extremely unimportant to you.

- Analyse new ways of increasing finance. Like, you can do any side job along with your main work to earn more money at a time.

- Hold yourself back from spending too much on those items which have a short shelf life.

Benefits of personal finance

Personal finance or financial planning lead you to several benefits:

- This teaches you discipline not only in money but in other aspects of life as well. The inward and outward flow of money makes the mind clearer that you have to maintain a balance between expenses and savings.

- Knowing financial strategy helps you analyse whether it is the right time to spend money on something or not. You have a good grasp of what is an actual need and what’s not so you can make a wise decision.

- This helps you to think rationally about any service or product. Instead of flowing in emotions and buying anything, you decide if you need it.

How to buy and sell nft read complete guide here.

Platforms that make you aware:

There are not so many platforms from where you can get financial knowledge. Still, the following are the worthy platforms to learn about personal finance:

Blogs and articles

There are so many blogs available that give you marvellous information about every angle of financial planning. So many tips, what should be done and what should be avoided, rules and principles, the best marketplace to invest and much more knowledge are available in these blogs and articles. Like the difference between investing vs trading and all about your finances.

Read full guide on rule of 70.

Remote courses

There are a few remote/online courses also available which give you end-to-end guidance on money management.

Institutions

Very few institutions and colleges are also there where courses regarding finance management are included in their curriculum.

Conclusion

Yes we earn to spend but spending thoughtlessly will lead us to a financial crisis someday. And to avoid such a situation, financial planning and management are necessary. Identification, analysis, decision, and implementation of the principles and ethics of money management can help you solve a lot of your monetary problems.

So, from now on, do not spend your money without a plan. Make a strong strategy and apply it in a powerful way to get the best results.

Frequently Asked Questions(FAQs)

1. How can I make a budget?

Ans: First, you need to identify your total income and overall expenses. After having an idea of your budget, you can cut out the expenses and can save a little extra.

2. Is budget even necessary?

Ans: Yes it is, it gives you an overview of your total expenses and earnings and allows you to make changes to save more.

3. Should I get insurance?

Ans: Insurance protects you from the uncertainties of life. Getting insurance won’t be a regretful decision at all.