How to Budget Money: 11 Technique to make a perfect budget

Introduction:

If you want to have control over your personal finance, then you are in the right place. No matter how much you earn, if you don’t know how to budget your expenditure then you won’t to able to track your financial flow. Making a budget is the best and simple way to analyze the end-to-end flow of money. You can easily make a budget that suits you and your income by following below mentioned ways. But before creating a budget, you need to know what a budget even is?

What is a budget?

A budget is a written draft through which you examine where is your money going and help you to create plans on how you can spend and how to save money effectively. Although this is not an activity that interests you once you start making a financial budget, you will definitely notice some good changes in your monetary flow.

Why is a budget important?

Creating a budget that complements our income and boosts our savings is a crucial thing to do. Budget can help you-

To control your spending

Through the budget, you can control unnecessary expenses. A budget helps you to differentiate between needs and desires so that you eradicate unessential expenses from the list of your expenditures.

To track the expenses

Only wiping out the needless expenses won’t work unless you keep an eye on your needful expenses as well. You must know how much money you are spending on your basic needs and for this, you have to create a budget.

To save and invest

If you are able to minimize your expenses, you will save some amount and will be able to invest them in suitable places. Thus, a budget helps you in saving and investing money by deducting the non useful expenses.

How to create a budget?

Creating a full-fledged budget may sound difficult but it is not. You can easily create a good budget through these ways:

Assemble your monetary documents

This is the very first step to making a budget. You need to collect all your financial documents such as your payslip, bank statements and receipts, household bills and credit cards bills, mortgage statements, etc.

Determine your income

You need to determine your income from all the sources. These sources can be your job, side work, freelancing, interest on savings, returns on investments, interest on given loans, etc. You need to calculate your overall income by counting all the possible sources.

Top 10 business ideas for college students to earn money.

Total expenses

After calculating the income, you need your overall monthly expenses. This includes your house rent, electricity charges, food and groceries, fuel and transportation charges, etc. Apart from these, there are a few expenses which you need to pay on yearly basis, such as interest on taken loans, premiums of policies and insurances, income and property taxes, etc. You can use your bank statements for the last few months to check up on these expenses.

Learn how to differentiate?

You must learn how to distinguish between mandatory and fluctuating expenses. Mandatory expenses are those which are fixed each time you pay them and fluctuating expenses, as the term suggests, fluctuate with every payment. Start keeping a fixed amount for the expenses of both the category. Practice this for a few months to know how much money these expenses need.

Deduction

You have got your total income and total expenses, now you need to subtract the expenses from your income to get the amount of net income. Through this, you get to know how much amount you have to save and invest.

Cutting out the expenses

You need to understand whether you are spending money on the right thing or not? And after analyzing, you should know how to cut out those expenses which are not necessary. These can be frequent dining out, picnicking with friends, less useful subscriptions, etc. They may seem a small amount but once you reduce them, you will surely notice some good results.

Fix your debts

To start saving, you first need to eliminate your debts because you need to pay more and more interest on the debts. Hence, paying off debts is necessary to step to be taken if you desire to save money.

Use bank accounts

Money that can be earned without investments is a good thing to hear, even if it is a small amount. Opening a savings account in a bank can help you to get interested in your finance.

Limits

You can set limits of a particular amount on your regular bank accounts, if the limit exceeds, then the exceeded amount will automatically be transferred to your savings account. This will prevent you to spend carelessly.

Credit cards limits

You should set a monetary limit on your credit cards so that you don’t do overboard while using them. This will help you to save a good amount of money.

Here are the best credit cards for students in 2024.

Invest the savings

After saving money, you should invest it in share markets, mutual funds, SIPs, etc. after analyzing the marketplace which suits you best.

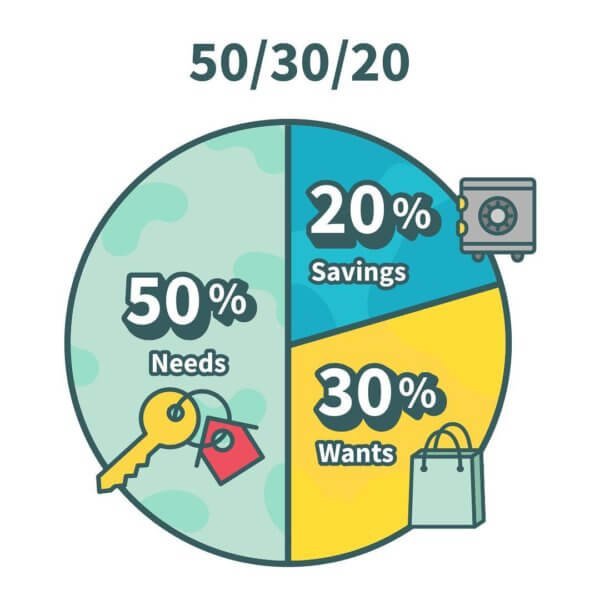

The 50:30:20 Budget rule

If you want to save money without compromising your needs, then you should make your budget with this rule. As per this rule, your have to divide your earnings in 3 sections:

- First, you need to fulfil all your fixed and variable needs in 50% of your total income. This rule suggests you to keep half of your total earnings for fulfilling needs.

- Now, you should spend 30% of the remaining income on your wants or on your desires such as, dining out, shopping etc. Though this isn’t mandatory, there is no one who doesn’t have desires, so keeping a part for your wants is necessary.

- Now, all you have fulfilled both your needs and desires. So, you are supposed to save the remaining 20%. You can either put this in a bank or can invest this in the share market, mutual funds or wherever you want.

This is the 50:30:20 rule of budgeting which will give you desired result without any compromise.

Classifications of Budget

A budget can be broadly classified into the following categories:

Simple budget

As the name suggests, this does not require any special financial knowledge. All you need is just to track your spending, adjust your expenses, and try to fetch savings from them. This is so simple and easy that any person of any age group can perform this.

Personal budget

Personal budget can be made by those individuals who do not have any big responsibility on their shoulders. They do this only for small benefits which can be small cashback, rewards, etc.

Read about Swagbucks which helps you to earn money while doing tasks.

Budget for beginners

This can be done by following steps:

- Calculate income: First, compute all your income from all your sources. If you are a student, then a part-time job or pocket money can be your only source of income. Calculate it and get an exact total.

- Count unavoidable expenses: Now, count all those expenses which are necessary such as food, house rent, books and college expenses, etc., and keep an amount for these expenses which shouldn’t be spent on something else.

- List deductible expenses: Find those expenses which can be deducted or wait for some time and try not to spend on them.

- Ultimate savings: After earning and reducing necessary expenses, what you have are your ultimate savings.

Budgeting can be easy if you how to manage money. This will also help you to unlock more investment options.

Budget for low income

You need to follow this rigidly if you want to see benefits from it. Following are the ways for budgeting in low income:

- Make a plan: Make a tight plan of monthly expenses which are very basic needs and are impossible to avoid.

- Dining out: You must either minimize or stop eating out if you want to save money because dining out can be an expensive activity to perform.

- Unnecessary expenses: Avoid unnecessary expenses such as shopping for those things which are not needful. Instead of taking so many subscriptions, you should shift to free platforms.

- Side work: Start doing something more along with your job. This will boost your income very rapidly.

- Quit harmful practices: You must quit harmful practices like smocking and consuming liquor. These habits are expensive and ruin your health. If you do something like this, then you must stop it in order to save both money and health.

Conclusion

A budget is an important tool through which you get the whole knowledge of your monetary affairs and financial position. Everyone who wants their future to be secured must create a budget and by following all the above information, anyone can easily make a well-structured budget. But, only creating a budget won’t work if you don’t follow it seriously. You need to stick with your budget and you can bring changes to it as per the requirements.

Frequently Asked Questions (FAQs)

1. Is the budget really important?

Ans: Yes, creating and maintaining a monthly or yearly budget is an important task everyone should do. This gives you an overview of your financial position and over time, you discover a lot more ways to save money.

2. Can I also create a budget?

Ans: Anyone with minimum financial knowledge and a will to explore can create a budget.

3. Is a degree course required to make a budget?

Ans: No, you need to be a bit aware of your monetary status and you will be able to make a budget that will complement your earnings well.

4. What’s the 50-30-20 Budget Rule?

Ans: The 50-30-20 Budget Rule is Simple in which from you should divide your total income or salary into 50% in Spends or Your Expenses, 30% in your Wants and 20% into saving or Investments.